Last Friday’s Department of Energy (DOE) move to temporarily pause pending requests to export liquefied natural gas (LNG) outside the United States has elicited not only a firestorm of criticism (including from us), but also proposals in Congress to reverse the DOE action. Just two days ago, for example, House Energy and Commerce Committee Chair Cathy McMorris Rodgers announced that the House would soon vote on a measure to overturn the LNG pause, while a group of Republican senators introduced legislation to eliminate DOE’s power to block natural exports altogether.

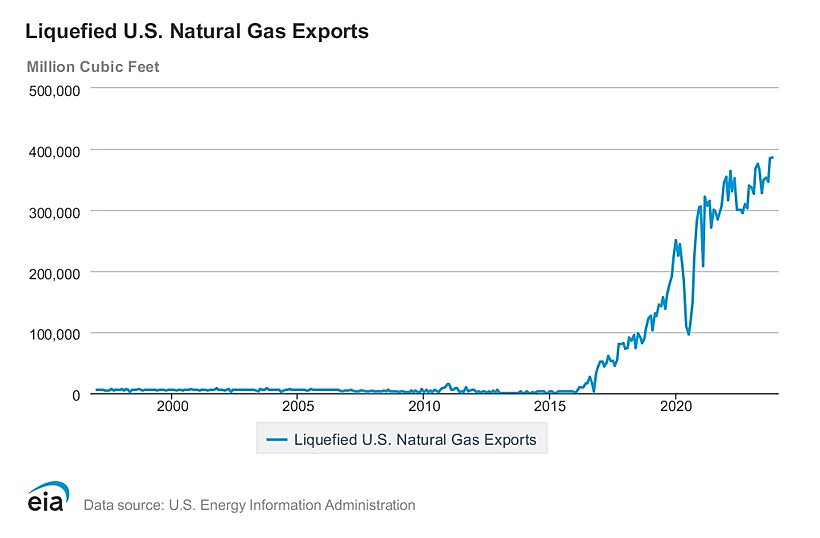

At stake is a burgeoning industry with domestic and international significance, both economically and geopolitically. The recent growth in LNG exports from the United States should not be taken for granted—the fact that the United States went from importing LNG just fifteen years ago to the world’s largest exporter is an amazing feat and a testament to the powerful growth enabled by (mostly) unhindered production and free trade.

As I explained in a new column for The Dispatch and in a 2013 Cato briefing paper on US energy export restrictions, systemic reform—not simply a narrow reversal of this week’s DOE pause—is needed here. That’s because current law (the Natural Gas Act of 1938 and its amendments) provides DOE—and thus any president who might just be in the middle of a close reelection campaign—with essentially unlimited discretion to block natural gas exports destined for countries without a free trade agreement (FTA) with the United States on undefined “public interest” grounds.

Given that many US LNG export shipments are “destination flexible,” and that most of the world’s biggest and most geopolitically‐important LNG consumers—including in Europe and Asia—don’t have a US FTA, getting a DOE‐approved export license is essential for US LNG projects. That fact, in turn, makes the approval process an almost‐irresistible point of attack for anti‐fossil fuel activists and any politician wanting to win their support. Reforming that process to take DOE—and thus politics—out of the equation (and thus put far more knowledgeable private investors in charge of these important, billion‐dollar projects) is a smart and obvious move.

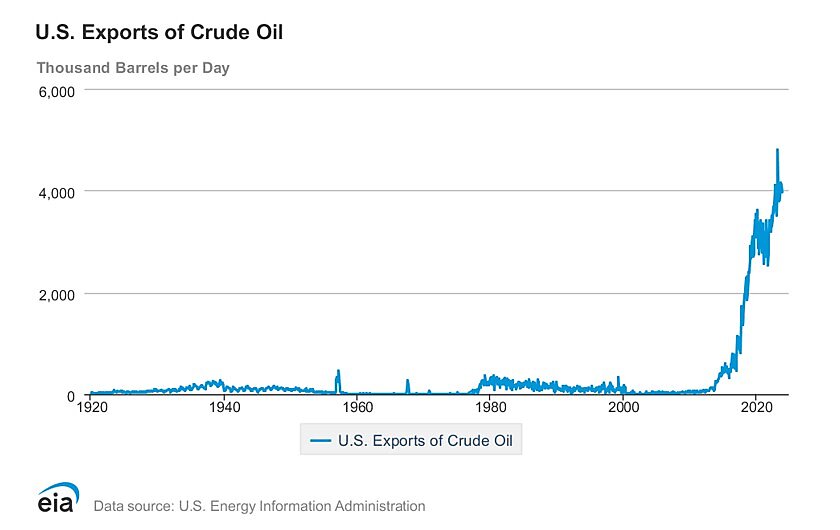

There is, moreover, precedent for just this kind of reform. Back in 2013, for example, I advocated for eliminating the outright ban on US exports of crude oil—something Congress finally did via a 2016 law that allowed the president to block US oil exports only in times of a declared national emergency. (Who says Congress doesn’t work fast?!) After decades of exporting virtually no crude oil, the United States has become a global oil export powerhouse, improving both domestic and global energy security.

At the same time, liberalization did not put significant upward pressure on domestic gasoline prices: As the US Government Accountability Office explained in a 2020 report, “[b]ecause gasoline prices are largely determined on the global market, U.S. refiners could not pass on to consumers the additional costs associated with the increase in crude oil prices.” Even though last Friday’s action affects only pending LNG export applications and thus leaves current approved capacity unaffected, all US natural gas producers and exporters deserve this same freedom, to the benefit of not only these market players but also global energy markets, the US economy, and US foreign policy.

Congress seems poised to act. For example, Senator Tim Scott’s (R‑S.C.) Unlocking Domestic LNG Potential Act of 2024 removes the “public interest” determination from the DOE’s purview and hands it—in a stricter form—to the Federal Energy Regulatory Commission (FERC). This would be a positive move in at least two respects.

First, Congress should not let the DOE play politics the way it did last week—it should take back the authority the DOE so clearly abused. Second, returning the authority to FERC is consistent with past practice (recall that the original authority in the Natural Gas Act of 1938 went to the Federal Power Commission, renamed to FERC in 1977), would give LNG exporters a one‐stop‐shop for environmental and public interest review, and would mitigate against future political abuse.

Although FERC is not perfect, it has been a bulwark against Executive Branch politics, as it demonstrated in rejecting a 2018 DOE proposal to bail out coal and nuclear power plants. An additional reform that would make the transport and trade of natural gas the default policy would be to allow some Natural Gas Act filings to go into effect by operation of law, as with Federal Power Act filings, rather than languish at a deadlocked or understaffed FERC.

Of course, it’s not just the Natural Gas Act that needs reform. As I noted this week (and repeatedly in the past), US trade law is littered with measures that let the Executive Branch—and thus politics— decide the fate of private commercial transactions that just‐so‐happen to cross national borders. The Trump‐era Department of Justice, in fact, went so far as to claim in court that one of those laws— Section 232 of the Trade Enforcement Act of 1962—would let the president ban imported peanut butter on subjective “national security” grounds. And US courts have been loath to question such declarations, even when the president himself admits that the laws’ conditions haven’t been met.

Other potential declarations of national emergency have crept into the energy space, including proposals to use Section 202(c) of the Federal Power Act (another DOE function) to prop up coal‐fired power plants. At one point in President Trump’s efforts to boost the domestic coal industry, invoking the Defense Production Act was on the table.

Because the risk of politicization is ever‐present, these laws need reform too. But, as the LNG pause demonstrates (and given the stakes involved), the Natural Gas Act is a great place to start.

Travis Fisher, Cato’s Director of Energy and Environmental Policy Studies, contributed to this article.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack