Daily Standup Weekly Top Stories

Russia’s Pipeline Gas Exports to Europe Pick Up

Russian pipeline gas exports to Europe continued their recent uptrend in the first half of August, with average daily flows hitting their highest levels since August of 2022, Energy Intelligence calculates based on gas transmission data. Combined […]

The 2003 northeast blackout and how today’s blackout risks differ

At a time when reliability concerns are plaguing most regional power grids in America, it helps to remember one of the largest blackouts in the country’s history — the 2003 northeast blackout. Twenty years ago on August […]

Hydrogen cars: Despite few buyers, California may pay $300M for fuel stations

By Alejandro Lazo | CalMatters Electric cars are rolling off production lines, and one in five new cars sold in California this year is battery-powered. “California is showing the world what’s possible,” said Gov. Gavin Newsom, […]

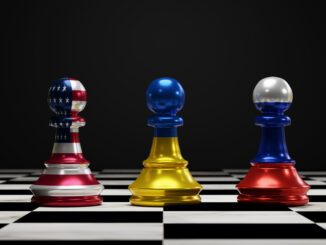

White House on Alert Over Rising Fuel Prices

Rising gasoline prices in the US are starting to put pressure on the Biden administration in the run-up to next year’s election. The national average for regular unleaded gasoline was trading at $3.87 per gallon […]

Governor Josh Shapiro’s Wrong Approach to Grid Reliability

Pennsylvania Governor Josh Shapiro has asked regional power grid operators to enhance the electricity system’s dependability—and he’s got ideas about how to do it. But his premises are flawed, and his suggestions misguided. Shapiro wants reliable […]

Highlights of the Podcast

00:00 – Intro

01:35 – Russia’s Pipeline and Gas Exports to Europe Pick up

04:38 – 2003 Northeast Blackout and how today’s blackouts differ

10:26 – Despite few buyers, California may pay 300 million for a fuel station.

12:29 – Rising gasoline prices in the US are starting to put pressure on the Biden administration in the run up to next year’s election

16:32 – Governor Josh Shapiro is wrong Approach to grid reliability.

21:11 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Stuart Turley: [00:00:15] Hello, everybody. Welcome to Saturday. This is the weekly recap for the Energy News podcast. We had a wild and crazy week. There’s a couple of things that I just want to share out that were not on our stories. We had a Doomberg that was released this week. It was a fabulous podcast, if I say so myself. And we also had Rey Trevino. He was on site drilling a well, and we’ve talked to a lot of people. If he gets real estate. 1031 exchange. Go to that article and you’ll be able to see our full e-book, if you would. Then we also had just before that Ronald Stein. And that was the one before that. Michael and I had a lot of fun this week. Enjoy the show. There is a couple of other stories that we’re going to be looking for next week. More updates on BRICS. Putin was not able to go there, but he did talk to them. There were some other big developments. And we’re going to let you know what President Obama, Hillary Clinton and Putin’s chef all have in common. But stay safe. Have a great weekend. See you later. Russia. I always love me a good Russian. Putin called the other day. [00:01:30][75.4]

Michael Tanner: [00:01:31] Hey, how’s he doing? [00:01:31][0.7]

Stuart Turley: [00:01:32] You got some time. Russia’s pipeline and gas exports to Europe pick up. Oh, holy smokes. The gas exports continued their trend in first half of August. Combined flows via the only two gas line. Gas lines available from Russia to Europe, excluding Turkey rose 6% to 1.3 billion cubic meters, or 90 million cubic meters per day. That’s a lot of gas. That is. Gazprom’s prices are understood to have fallen further in August. Here’s where it gets a little funny. There are some pricing matrices that are going on when we’re paying $2.30. What’s gas right now? Two 5250. [00:02:21][49.6]

Michael Tanner: [00:02:23] We like not like natural gas or gas at the pump. [00:02:26][2.6]

Stuart Turley: [00:02:27] Natural gas. Sorry. [00:02:28][0.8]

Michael Tanner: [00:02:28] Oh 258 is going to be like 340 last week for pegging. [00:02:31][3.4]

Stuart Turley: [00:02:33] A comparison price of what they’re expecting is going to be around the 15 to 25. $15 to 25 difference is what they’re going to be paying. [00:02:42][9.8]

Michael Tanner: [00:02:43] Nice. Nice. [00:02:44][0.5]

Stuart Turley: [00:02:45] Hey, if you go green without a plan, you pay for it. [00:02:50][4.6]

Michael Tanner: [00:02:51] We added. And again, it shows as you always sound preaching to the choir here, sanctions don’t work. [00:02:56][4.9]

Stuart Turley: [00:02:56] Now, the Turkstream supplied more than 31 million cubic feet per day in 2021. Bulgaria receives 8.1 million. Let’s see here per day. Ex. Russia’s exports of LNG to Europe have held up well despite the war and accompanying deterioration in political relations. Michael, what this is, is people will buy energy just about no matter who the bad guy is. [00:03:29][32.9]

Michael Tanner: [00:03:30] And because you need it, you you can’t not go without energy. You’re going to get it from somewhere, whether it’s coal burning wood, whether it’s $17 natural gas or however you can get it right. [00:03:44][14.1]

Stuart Turley: [00:03:45] But here’s here’s a couple of key lines in here. Spain, which lies well beyond the reach of Russian gas pipelines, remains one of the key importers of Russian LNG. Spain has six LNG import facilities there, the biggest one in the EU. They can do that. Turkey became a regular importer of Russian LNG, taking cargoes from Gazprom’s newly launched Voya LNG facility. They just had their second train come on in the Arctic train and they have now beef that went up. So their Arctic coming around their one in a shout out to Patrick Moore. We cover how Russia is transporting this over the ocean. Everything else. That is a heck of a gas coming out man. As net. [00:04:36][50.8]

Michael Tanner: [00:04:37] That’ll be fine. That’ll be fine. [00:04:38][1.1]

Stuart Turley: [00:04:38] 2003 Northeast blackout and how today’s blackouts differ. Michael, do you remember the 2003 blackout? [00:04:46][7.8]

Michael Tanner: [00:04:47] I was eight years old. [00:04:48][0.7]

Stuart Turley: [00:04:48] You were blacked out in college? I think probably at no time. [00:04:52][3.2]

Michael Tanner: [00:04:52] Ten years old. I was like, ten years old. [00:04:53][1.3]

Stuart Turley: [00:04:55] Yeah. Okay. Never mind. At a time when reliable the 2003 northeast blackout 22 years ago on August 14th, this was a bad one. Unusual instance. There’s going to be a chart we may want producer to. Fly in here in a little bit. A series of management errors led to the escalation of events that caused the grid. And the grid. Over 55 million people were affected by the blackout. Some went without power for a couple of hours. Others suffered for weeks and days. 400,000 EP subway goers were stranded underground while the power went out during the blackout. Water customers in Cleveland, Detroit, were placed under a three day boil advisory. So this was no lightweight disaster. Cell service was interrupted. Total societal cost were around $10 billion. So we’re talking some serious. Mr. Producer, if you could fly in this chart when we’re talking about the 2021 ERCOT. Michael, this is critical. That blackout of 2003 happened in in the left hand column. You’re going to see 90% was never dispatchable. Dispatchable is either nuclear gas or coal. 9% was intermittent or renewable. It’s scary. And so you see 9% was hydro rollover to what happened to ERCOT? ERCOT in 2021, 16% was renewables, 8% was hydro in that area and 76% was dispatchable. What’s happened? Coal has come down. Natural gas has really come down and renewables have come up to that. 16. What’s changed as far as the grid policies that’s going out further? Does that make sense? Yeah. [00:07:02][127.9]

Michael Tanner: [00:07:03] If what happened in 2003 was the product of poor management, right? And only what’s happened in 2021 going forward is a product of stupidity. And we’ve been continually down the path of, I mean, that chart that US energy mix 23 versus just 21 says everything in my opinion about the current state of what our of what our energy mix is. The fact that we only have 76% dispatchable percent of our total capacity is scary and we’ve actually dropped Hydro, one of your favorites. Speaking of Bear Country. [00:07:36][33.1]

Stuart Turley: [00:07:37] Yeah, I got it right over here. I love Medium Hydro, by the way. There’s a couple of quotes in here. Bad policy favoring renewables cause the 21 2021 blackout, as Dr. Brant Bennett of the Texas Policy Foundation pointed out, based on Ercot’s own forecast, it was an inevitable that this weather event was going to cause demand to exceed supply, even if no wind or fossil fuel generators had failed due to weather bad policies, Dr. Bennett noted. In 2021 blackout disaster was in the making directly due to policies that resulted in the grid, quote, relying entirely on wind and solar to meet our Texas demand growth since 2015 and has now less coal and gas generation in total than it did five years ago. A poorly planned grid is waiting disaster to happen. [00:08:39][61.5]

Michael Tanner: [00:08:40] It really is. We did it to ourselves. And so when this all crumbles, at some point we know who to blame. US. Unfortunately. [00:08:46][6.3]

Stuart Turley: [00:08:48] Not me. I got generators. I got I. [00:08:51][2.7]

Michael Tanner: [00:08:51] I’m the one that’s going to die here. I’m just in an apartment. Yeah, I’m driving up to see you. [00:08:55][4.1]

Stuart Turley: [00:08:56] But they’re coming after your generators, so it’s a good thing you don’t have a generator in an apartment because they would. [00:09:00][4.4]

Michael Tanner: [00:09:01] They’re coming in. Anyone coming After everything. [00:09:02][1.4]

Stuart Turley: [00:09:03] But you could see how we wove all the stories in and out on this. They all are regarding energy. The way the right way to do it is the e the the Middle Eastern company countries. I don’t agree with their social policies, but they have their energy policies. Right. They’re going to get to net zero, but they’re going to do it by making money, doing it right and doing it in a plan. We are not planning for nothing. [00:09:33][30.5]

Michael Tanner: [00:09:34] Moment of silence for Stu, genius. All right, that’s enough. Let’s dive into this first story, though. Hydrogen cars. This is hilarious, guys. Despite few buyers, California may pay 300 million for a fuel station. So to give you guys an idea what’s what’s going on right now, you know, one in five new cars right now in California are actually battery powered, which is interesting. This little quote by Gavin Newsom, California is showing the world what’s possible. Could he be running for president? I only know. But to give you an idea what’s going on in the Democratic state legislator right now is there’s the drip baiting. How much money to give companies to build hydrogen fuel stations. So a lobbying group or. Hydrogen supporters, including Chevron Shell. Oh, I love it. You’ve got big oil. You’ve got big car combining to try to extract 300 million to do hydrogen, which nobody’s got. So I jumped the gun a little bit. Chevron, Shell and Toyota, they’re seeking to designate 30% share of the money from the state clean transportation program, amounting to over 300 million over the next decade to roll out hydrogen fueling station. Mind you, we don’t even electric cars in the next ten years is going to be difficult. Chevron, Shell and Toyota attempted to convince us that they need 300 million. Hydrogen farms. Hydrogen farms, but hydrogen fuel stations. Okay. I don’t want. I’m not even really sure I’m for nuclear. We know my stance on nuclear. I. I see Chernobyl happen. I mostly kid. I think I nuclear’s probably move. We need to invest. My point is who wants to put hydrogen in their car? What happens when I get hit by another car? Is that is that is that a bomb just sitting there? I mean, it’s it’s sort of what it is now. I think the funny part is I say all this to say classic California. What they want to do is they want to come in and say 300 million. Right. Really? Really now. I get hydrogen fuel cells. They they they they they basically say, well, we believe that hydrogen fuel cells are the next step beyond electric out electric cars first. You know, it’s like going from A to C. Well, give me B first. At least get beat out before. Are you going to be you know, the article also mentions they’ve already spent $202 million on hydrogen fuel stations, yet they only have they’ve only sold 1700 of these cars. So you can actually go get one. You can go get a driving bomb right now if you want. But. And what is that per person? 200 million times divided by 2100 K a station. That’s no wonder K station. It’s ridiculous, guys. Classic. What’s going on in California? There’s only about 12,000 hydrogen cars around there, but there’s about 760,000 batteries. So we see where Californians are going continue to dump more money into things that will never be needed. We love it. [00:12:14][159.4]

Stuart Turley: [00:12:14] Oh, man, my old the pen boy here, he’s looking for his depends. Hey, did you see that? He offended everybody at Hawaii Mountain. [00:12:24][9.9]

Michael Tanner: [00:12:25] Fell asleep. I saw. That’s ridiculous. [00:12:26][1.4]

Stuart Turley: [00:12:26] Oh, my gosh. What a knucklehead. Rising gasoline prices in the US are starting to put pressure on the Biden administration in the run up to next year’s election. Michael. This. I got to be nice. Diesel, meanwhile, has risen to 438 a gallon from 384 a month ago. This is from bob mcnally. Any White House has only two kinds of modes when it comes to oil prices. Obvious or panic bargaining. Now a president of consultancy of Red Pan Energy and former senior director for international energy for the White House National Security Council. What would really flip them into true panic mode, Michael, is where when oil prices kept rising with them, yet at 90 to $100, he says, that’ll really flip them out. The problem is let me get some numbers here. We are the largest sale. They did 188 million barrels and currently holds 350 million barrels. That is the smallest it’s been in 45 years. And so when you sit back, Saudi is cutting 1 million barrels a day, 100,000 here and is not going to make a difference in no way to U.S. producers can fill the gap. They come down here and then even the Biden administration is bragging that U.S. is going to increase to 13 million barrels per day. So the hypocrisy of the Biden administration is just you got to congratulate them for the hypocrisy in motion there. No, they now, if if they take this down, let me just give my Stewart’s earlier opinion floor is yours. Okay, China, when things go bad, right. Things are going bad. The economy is going bad in China. What is China? Do they normally everybody has started a war. Look, that’s and then they go over here and start a war. They could be starting a war in Taiwan. What are we going to do? We got a war in Taiwan besides having a knucklehead up there, you know, doesn’t even know where he’s at or he’s they’re saying that his. Oh, what was the joke that he said yesterday? He almost lost his car and his wife and his dog or something like that. I mean, it was pathetic. What’s going to happen is we only have 350 million. How many do many millions a day do we use in the U.S.? That is less than a 20 day supply. That is less than that. You get anybody at OPEC group doubted us. Russia is now also. Going to cut at 1 million barrels per day. 100,000? I mean, a million barrels a day. What was it recorded? I got a fact check myself. They are going all in on this next Opec+ cut. They’re going in. [00:15:24][178.0]

Michael Tanner: [00:15:25] So, yeah, I mean, I’m if if war with China starts, we’re screwed. That’s all I’ll say. Gas prices are going through the roof. [00:15:34][9.3]

Stuart Turley: [00:15:35] And even if China is. [00:15:37][1.5]

Michael Tanner: [00:15:37] Storing, they’re ready for this. [00:15:39][1.5]

Stuart Turley: [00:15:40] Oh, they’re ready for. [00:15:41][1.2]

Michael Tanner: [00:15:41] Oil. They’re ready for this. It’s scary. [00:15:43][1.3]

Stuart Turley: [00:15:43] They’ve been buying everything they could. They bought more gold than they could have ever imagined. BRICS is meeting today or yesterday. BRICS is in this meeting. You had all the representatives from China, South America, Brazil, India meeting with Xie in China. And the big question is, are they going to be able to do it? And my answer is yes. They’ve been doing this since, I believe, 2009 on BRICS, trying to bring it forward. Guess what the catalyst was? It was Biden. Do you remember that one quote that I got to go to the next story here, Bill? You remember when Obama said don’t ever underestimate the ability for Joe Biden to f up something? [00:16:27][43.7]

Michael Tanner: [00:16:28] I do remember that. [00:16:29][0.8]

Stuart Turley: [00:16:29] Okay. Yeah, he just left up the U.S. dollar. Governor Josh Shapiro is wrong Approach to grid reliability. Josh Shapiro is Pennsylvania’s governor and in the commonwealth, he was sitting here and they have PJM failure to keep the lights on when there’s a little drama as reasonably possible during December’s cold snap is the beginning of the reliability issues Pennsylvanians will face as the grid operator continues to accommodate more renewable energy while endorsing policies that speed up the retirement of nuclear or fossil fuel based capacity. Got to give a shout out to Meredith Angwin. Her book, Shorting the Grid, explains mandates for new renewable energy will not succeed in building grids that are 100% renewable, but will instead make grids more fragile and more expensive. I’ll tell you what, Meredith is an absolute national treasure. And when you sit back and take a look at her grid book, go, I’ll have it in the show notes here, Read that book and you’ll understand a lot more why The grid is actually one of the most complex machines ever built. And you cannot change physics, you can’t change economics, you can’t print money in order to get to renewable. Just visit with Debra Wold, CEO of GreneLily, and I guarantee you she knows how to make renewable natural gas from waste that is renewable. To me, when you talk about solar or wind that you have to have and it’s not sustainable financially. That to me is a real worrisome issue. One of the it’s going to take Cesar Running Institute explains that each loss of gigawatt of baseload electricity generated by a coal and natural gas as well as nuclear requires three gigawatts of wind and solar to replace it. I think that number is actually a little low to replace the 40 gigawatts of baseload generation required by 2030, we’ll need to build 120 gigawatts of solar power. That number, I believe this little low using some of the crayon math that I use. And that’s another you know, I everything I’ve created in models or construction taking a look that nameplate gigawatt nameplate panel is always off. So if you need one gigawatt, you need to add another 180 wind towers. So you’re talking some serious issues here and they say 120 I think it’s closer to the 1 to 80. [00:16:29][0.0] [944.5]