Daily Standup Weekly Top Stories

A Shale Oil CEO’s Second Act: Going Green

For almost a decade, Tony Sanchez III was the epitome of a shale-boom CEO—furiously drilling oil wells, piling on debt and hunting quail and nilgai with fellow executives near his family’s ranch in South Texas. Then tumbling […]

The US isn’t the only one eating into OPEC’s market share — Brazil and Guyana are hitting record oil production volumes

OPEC+ has seen its oil market share fall to 51% this year, the IEA said Thursday. While US oil output has soared, Guyana and Brazil have also produced record volumes in 2023. Brazil’s output jumped […]

the next three years. The company’s […]

EXCLUSIVE: Conservative State Files First-in-the-Nation Lawsuit Against BlackRock Over Deceptive Climate Policies

FIRST ON THE DAILY SIGNAL—Tennessee Attorney General Jonathan Skrmetti on Monday sued the investment company BlackRock for deceptive practices. “BlackRock has said two things that can’t both be true,” Skrmetti, a Republican, told The Daily Signal in an […]

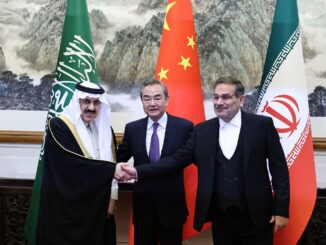

Strategy to End Iran’s Aggression

History continues to offer lessons and strategy to Washington if only the Biden Administration had the wisdom to hear it. Eighty years ago, the allies quickly realized that both Nazi Germany and Imperial Japan fed […]

Another Offshore Wind Farm Hits the Dust

Key Takeaways 1: The developer of “Icebreaker,” a small project in Lake Erie, announced it is pulling stakes on its six-turbine project. 2: The project received a $50 million grant under President Obama, but the […]

Red Sea Tensions Threaten to Disrupt Diesel Market Stability

Increased distillate production and slowing economic activities have led to rising diesel stocks and falling prices. Weak manufacturing activity in the U.S. and Europe contributes to reduced diesel demand, easing the market. Geopolitical tensions near […]

Highlights of the Podcast

00:00 – Intro

01:33 – A Shale Oil CEO’s Second Act: Going Green

04:38 – The US isn’t the only one eating into OPEC’s market share — Brazil and Guyana are hitting record oil production volumes

07:46 – EXCLUSIVE: Conservative State Files First-in-the-Nation Lawsuit Against BlackRock Over Deceptive Climate Policies

12:38 – Energy Workforce: Biden’s Gulf of Mexico leasing auction “detrimental” to U.S. energy supply

14:23 – Strategy to End Iran’s Aggression

15:55 – Another Offshore Wind Farm Hits the Dust

18:33 – Red Sea Tensions Threaten to Disrupt Diesel Market Stability

21:37 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:14] What is going on. Everybody, welcome into a special edition of the Daily Energy News Beat. Stand up here on this gorgeous Saturday, December 23rd, 2023. As always, I’m your humble correspondent, Michael Tanner, coming to you from an undisclosed location here in Dallas, Texas, joined by executive producer of the show, the purveyor of the show and the director, publisher of the world’s greatest website, Energy News Beat.com, Stuart Turley, my man. Busy week. [00:00:37][22.7]

Stuart Turley: [00:00:37] Oh, it is. It’s just absolutely crazy. Got a lot of great stories out there. [00:00:42][4.5]

Michael Tanner: [00:00:42] A lot of great stories happening this week. Red Sea going absolutely insane. Another offshore wind farm bites the dust. We got everything. The team is going to cue it up with with our top segments from this week. Before they do that, guys, remember all the news and analysis you hear. It is brought to you by the world’s greatest website. Energy News Beat the best place for all your energy news. Stu and the team do a tremendous job of making sure that website is up to speed with everything you need to know. Is there the tip of the spear when it comes to the energy business? You can hit the link below on all your major podcast platforms and YouTube and check out the description links to all the articles timestamps so you can jump ahead. You can also email the show questions@EnergyNewsBeat.com Check out our Data News Product Dashboard.EnergyNewsBeat.com But until then, stay. I’m going to kick it up to the kids and the weekly recap. We’ll see you next time, folks. [00:01:32][49.3]

Stuart Turley: [00:01:33] A shale oil CEO’s second act going Green. Michael, I want to tee up our deal spotlight of Oxy and crown. And the reason for that is you and I didn’t know the outcome until we went through the steps. And it fits right into this because there is a way that Saudi Arabia is funding their move to green, just like Oxy is funding. Their move to green with oil and gas are a balanced approach is the only way that you’re going to get there, not shutting everything off. So let’s go to this story, Tony Sanchez. The third was the epitome of a shale boom, CEO drilling oil wells, piling on debt and hunting quail. I love that. In his ranch in south Texas, he got caught up in the the oil crash and everything else. But what were some of the things that caught you in this article, Michael? [00:02:35][62.8]

Michael Tanner: [00:02:36] Well, one, it’s one thing that caught me is if you’re familiar with the name Tony Sanchez or I’ve heard of Sanchez energy, absolutely the epitome of the early the mid 20 tens shale boom. I mean, when and when I mean, boom. And then I also should say the bust as well, because it ended with Sanchez Energy filing for bankruptcy. So I love nothing more than a failed oil executive building now through selling GRI and woe. So what’s his so if you read this article, do his current business one Nexis is a little bit different. This is his new business. He started I read a paragraph down here. One Nexis offers oil producers policies that pay out only when their wells are capped, ensuring that companies have money set aside. He’s now an insurance salesman. We went from he went, He’s literally an insurance salesman. Now. The rates are determined by actuary models that were adapted from human life insurance calculations, and the policy is structured to survive. Even if the oil producer or one Nexis goes bankrupt. He says, This is incredible. This is a legitimate this is the biggest grift I’ve ever seen. I love. [00:03:45][69.3]

Stuart Turley: [00:03:46] It, to be honest with you. If it’s, Hey, insurance rules the world, baby, You think the deep state does not. It’s insurance companies, insurance. [00:03:54][8.4]

Michael Tanner: [00:03:54] Sooner or later, Stu, you’re going to invite me to an event where I show up and it’s going to be Tony Sanchez up there. Hey, if you sell our policies and get five people underneath you, you’re going to be able to go to my president’s retreat with me in Cabo. This has multilevel marketing. I can see it now, Stu. One nexus. I’m a one Nexus business owner. [00:04:13][18.8]

Stuart Turley: [00:04:14] Yeah. Hey, if you see him as a sponsor of the show, you’ll know it’s on the way. [00:04:19][4.8]

Michael Tanner: [00:04:19] You’ll know he sold out. When one Nexus answers the show. And I’m here pushing insurance policies on you that you know. But take us off air. [00:04:28][8.3]

Stuart Turley: [00:04:28] Then we would have cradle to grave. We would not only be on the front end evaluating M&A, we’d be evaluating on the back end there. So that’s. [00:04:36][8.2]

Michael Tanner: [00:04:37] About me in saying. [00:04:37][0.6]

Stuart Turley: [00:04:38] The US isn’t the only one eating into OPEC’s market share. Brazil and Guyana are hitting oil production volumes as Governor Abbott is signing in. You know the deals that he’s doing, we’re getting more natural gas plants online. And when you sit back and take a look at not only total energy is investing in. In Texas. [00:05:02][24.1]

Michael Tanner: [00:05:04] Wee, wee. [00:05:05][0.2]

Stuart Turley: [00:05:05] Wee. You were doing well. What was it, Mike Myers, That you were just doing that. [00:05:10][5.0]

Michael Tanner: [00:05:10] Like some old school French way we beat. [00:05:12][1.9]

Stuart Turley: [00:05:13] Oh, no. You were talking about doing one of them evil characters that has a cat, Mr. Evil mystery out on cats. I’m sorry. No, but Mr. Evil. Mike Myers, bald. And he’s from Ohio. I’m going to hold the world ransom for million. [00:05:29][15.9]

Michael Tanner: [00:05:30] Okay. [00:05:30][0.0]

Stuart Turley: [00:05:31] So let’s go back to this one. Brazil and Guyana. You have the pricing model around the world. We’re going to cover this in more detail in the next few weeks. OPIC has seen its market oil market share fall to 51%, the IEA said while U.S. output has soared, Brazil’s output has soared 400,000 barrels a day to 3.6 million. Now, here’s the thing. Part of that number, Michael, I’m digging around on the CIA’s number, and it’s 51%. It is the dark elite. I’m going to do my Biden real quick. Everybody on our podcast, I’m leaning into the mike. I’m losing my mind as I lean in and go, It’s the 51%. Okay, so that was my Biden. That’s about all I can pull on that knucklehead. So why when we sit back and take a look at the pricing model, Michael is busted. And I’m working on some more stories on this because it effects Texas, so goes Texas goes the rest of the world. Anyway, I don’t know why my camera just. [00:06:35][63.8]

Michael Tanner: [00:06:35] Zoomed in, as you say. It knows it knows that that’s exactly as. [00:06:39][4.4]

Stuart Turley: [00:06:39] Creepy as it. [00:06:40][0.7]

Michael Tanner: [00:06:41] Gets. I mean, it is interesting that OPIC is losing its grip and it’s kind of clear with with that over the years, OPEC has been losing its grip, if only because, look what’s happening right now. OPEC is continued to cut and signal that they are going to cut production and are going to continue to cut until they can bring Brant Oil up. And what is oil done the past three months? Tumble, tumble, tumble. I mean, can’t be too mad at $71 oil but thinking about where Saudi Arabia and oh back and Russia and everybody wants oil prices to be it’s insane that they haven’t been able to achieve yet that so it’s clear that there are other sources a.k.a. Brazil and Guyana, as this article rightly points out, is the reason for that. I mean, it’s it’s it’s pretty high. It’s pretty insane. [00:07:26][45.6]

Stuart Turley: [00:07:27] It’s pretty insane. And the whole pricing paradigm, Michael, is changing. So it goes back to our great oil and gas in the US and then the war on oil that the Biden administration is done by trying to source oil through Venezuela or other countries. It’s just criminal conservatives. State Files first in the nation lawsuit against BlackRock over deceptive climate policies. Michael, this is kind of you cannot be this kind of entertainment. The city Attorney general Jonathan Carmody on Monday sued the investment company BlackRock. Here’s a quote. BlackRock has said two things that can’t both be true. Carmody, a Republican, told The Daily Signal in an interview Monday. The first is that they are taking investors money and investing it purely for the purpose of maximizing the return on the investment. But they’ve also put out a statement saying that they are committed to net zero carbon emissions to combat climate change by a certain date. Both things can’t be true, and I agree that he is is hitting on that. The here’s where it gets a little funny. I’m going to be wondering how it’s going to pan out in the courtroom, Michael, because pledge member of the climate groups is to force companies to disclose their targets for net zero emissions for environmental and political reasons. This is coming down into the carbon tax. It’s coming down into the MP operators. But here’s where this I get a little confused on this article. The Larry said it’s okay to invest in ESG, in oil and gas. So where I think this is really going to need a follow up is the requirements for carbon neutral for reporting from oil companies. [00:09:20][113.6]

Michael Tanner: [00:09:21] This is a serious question. So to take this, it’s again, this is a serious question I’m asking, are companies on are companies required to make a profit? [00:09:30][8.4]

Stuart Turley: [00:09:30] Yes. If they are says who they are, they have a requirement to their. [00:09:34][4.1]

Stuart Turley: [00:11:50] But they do have a fiduciary responsibility for not I. That’s a good question. Do they are they legally responsible? Yes. Depends on your. [00:12:00][10.0]

Michael Tanner: [00:12:01] Responsibility. But that’s different than being illegal. Right. I’m not a lawyer. It’s a dumb question. But, you know, when we talk like like, for example, bankruptcies, bankruptcies, it’s not illegal to be an idiot and drive your company into bankruptcy. Now, you’re going to probably never raise money again. But the question is, is being incompetent illegal? I don’t. [00:12:21][20.9]

Stuart Turley: [00:12:22] Know. Well, it does take a village to raise an idiot. [00:12:24][2.8]

Michael Tanner: [00:12:25] So I’ll tell you this, though. If it’s illegal to be an idiot, Stu, we’re in trouble and we’re going to be knocking on our door very quickly. Oh, wait, that’s them. [00:12:35][9.2]

Stuart Turley: [00:12:36] I just had to go get the door. Energy Workforce. Biden’s Gulf of Mexico leasing auction is detrimental to the U.S. energy supply. Only three oil and gas sales are scheduled for the Gulf of Mexico in 2025 and 2027 and 2029, a departure from the previous plans 11 net lease sales. This is critical. When we talk about natural gas, we talk about oil and gas investment and low cost energy. The Gulf of Mexico great offshore producers do a great job. We have to remind everybody ourselves, the only reason the United States has reduced their carbon footprint is because of lowering natural gas or, excuse me, lowering the coal usage and increasing natural gas. Natural gas off the Gulf of Mexico is pretty important. You got to have that for LNG. You got to have that for exporting. That goes into the other article with Europe as well. It is all related. The Outer Continental Shelf produces 90 be estimated to hold 90 Bowie and 300 tfc g. If developed, these could be more than 800,000 American jobs. You know, we always hear about President Biden being a for the American workers. Let’s pony up, let’s reduce and let’s get to carbon net zero, but let’s do it using great American energy. So anyway, that was pretty cool article there. A strategy to end Iran’s aggression. I just want to go and go on record and say that I do not think the United States needs to go to war anywhere. I am not an fan of war. Lindsey Graham. If you’re listening and you’d like to come on this podcast. I would love to talk to you. Threatening to bomb Iran’s oil is not a way enforcing sanctions. The way Trump had is the way to do it. Iran under Trump 350,000 barrels per day production under Biden. With all of the sanctions they are going to be. I believe it’s 3.4 million barrels per day. Sanctions don’t work. And bombing them gets our kids killed. I just want to be clear. I am a humanitarian and we need to not bomb people. Missiles fired by Yemen’s Houthi rebels is really causing a stink around the oil there around the Red Sea. And it is going to cost the world billions. The supply chain is going to increase. Those stories are on there as well, too. But we do not need to have the U.S. bombing this in order to stop it. So I thought this article was a good one. But Hamas is definitely the enemy and we need to let Israel do their due diligence and take care what they need to do. Another offshore wind hits the dust. This one is kind of sad because it is very systemic of more coming around the corner. The developer Icebreaker, a small project in Lake Erie, announcing it’s pulling out stakes on its six turbine product project. It received a $50 million grant under Obama. You know, that longing is to to get attached to the grid. And the Energy Department has pulled the grant and taxpayers will only get $37 million back. So somebody made let me think. I went to ask you, how many millions did they spend on regulations measuring rocks to make sure they get get these things up. [00:16:45][248.7]

Michael Tanner: [00:16:45] Over six turbines? I mean, what could that power like? Barely power, anything? [00:16:51][5.8]

Stuart Turley: [00:16:52] No. I mean, you’re talking, you know, six wads. I mean, I’m kidding. Whatever. [00:16:58][5.6]

Michael Tanner: [00:16:58] I love this part. According to developer, icebreaker, became financially untenable after the Ohio Power City Board in 2020 required the turbines to stop at night between March and November to reduce the risk of migratory birds and bats from hitting the turbine blades. [00:17:15][16.5]

Stuart Turley: [00:17:15] Oh, yeah, and it’s even funny. A large Dominion Energy, a large utility in Virginia, is moving ahead with its consisting of 176 and is spending 625 million on the first U.S. built ship capable of hauling more than 300 foot long blades. It’s a lot of money just to haul a blade out and put it up with duct tape. That’s just amazing to me. And here’s the conclusion. I thought this was really good. Another offshore wind is calling it quits is inflation, Interest rates, supply chain issues and legal challenges are making it too expensive and difficult to exceed. Michael, we’ve seen that over the last six months. It is going to escalate and curtail wind. I still see solar here as having some wind and I. I had lunch with Dr. Ed Ireland and Artie. Here’s a great one. The young lady out of London came up with an idea for wind in some ways. At first I was like a great idea. They all create wind. Why not put a little turbine down there every time it goes through? You could make some really nice. I think it’d be kind of cool. Let’s go to the Red Sea tensions. But I’ll tell you, the warmonger. Oh, shoot. What’s his name? Graham. Lindsey Graham. Oh, my gosh. He’s calling. He’s actually calling for us to bomb Iran’s oil field. That’s no. Step away from the microphone, dude. [00:18:51][96.0]

Michael Tanner: [00:18:52] We went from the nuclear weapons. Never. [00:18:55][2.8]

Stuart Turley: [00:18:55] No way. You do not have the football. Step away from Biden’s side. We do not need to do that. No. Okay. Let’s go to the here’s where Red Sea tensions threaten diesel market. Michael, here is a whole nother side of the hoodie is out there playing around with them. Drones. These are not your drones that your dad used to fly around. These are some serious kind of drones. The below average distillate stocks and just an uptick in manufacturing construction next year. Iran has gotten another million barrels coming on line, a million barrels per day. And then so does India and so does China. So, oh, yeah, guess who’s buying the diesel and gasoline and products from China? Dan in California. [00:19:51][56.0]

Michael Tanner: [00:19:53] As you say, no. [00:19:54][0.6]

Stuart Turley: [00:19:54] And well, why did President Z show up and why was it clean? I don’t know. [00:20:00][5.7]

Michael Tanner: [00:20:01] He just wanted to meet our favorite governor. [00:20:02][1.2]

Stuart Turley: [00:20:02] I thought he wanted some hairstyle tips. But when we take a look at the it’s just. It’s weird. On how diesel is now. Also they’re peeling some of the dark fleet off for diesel tankers. It’s weird. [00:20:17][14.3]

Stuart Turley: [00:21:17] I couldn’t agree more. And the other side of that coin, though, is is the number one user of what was our you like before our podcast. I was just flipping a coin. Michael was starting to do a hula. [00:21:29][11.6]

Michael Tanner: [00:21:29] Was flipping a coin. [00:21:30][0.8]

Stuart Turley: [00:21:31] Oh, you’re oh, flipping a coin. Here we go. Heads or tails? Heads. [00:21:34][3.1]

Michael Tanner: [00:21:35] Heads. I win. Tells you lose. [00:21:35][0.9]

Stuart Turley: [00:21:36] It’s under the table. [00:21:36][0.0][1252.1]

– Get in Contact With The Show –