Daily Standup Top Stories

Energy Giants Create Global Synthetic Natural Gas Coalition

Supermajor TotalEnergies, another French energy giant, Engie, and U.S. Sempra Infrastructure have announced plans to create a global coalition to support the production and use of e-natural gas (e-NG), a synthetic natural gas produced from renewable hydrogen […]

Deutschland: How Germany Is Dominating Hydrogen Market

With 3827 kilometers of pipeline across the country, Germany is blazing a trail through the continent in terms of hydrogen infrastructure growth. Indeed, plans within the country are so far advanced that Germany is set to become […]

RED ALERT FOR THE NATION’S ELECTRICITY SUPPLY

Studies and press reports have been warning that our electricity supply is becoming less reliable, which means we are facing a greater chance of power outages in the future. This reliability crisis will come to […]

70% of Passive ESG Funds Are Exposed to New Oil and Gas Projects

A total of 70% of passive funds passed off as “sustainable” by five of the largest asset managers in the U.S. and Europe are exposed to companies developing new oil and gas projects, environmental organization […]

Oil slips as investors weigh Fed rate decision

NEW YORK, March 20 (Reuters) – Oil prices fell on Wednesday as the U.S. Federal Reserve held interest rate steady and demand concerns continue to weigh. Brent crude futures for May settled down $1.43, or […]

EIA: US crude inventories down 2.0 million bbl

US crude oil inventories for the week ended Mar. 15, excluding the Strategic Petroleum Reserve, decreased by 2.0 million bbl from the previous week, according to data from the US Energy Information Administration. At 445.0 […]

Highlights of the Podcast

00:00 – Intro

01:28 – Energy Giants Create Global Synthetic Natural Gas Coalition

03:41 – Deutschland: How Germany Is Dominating Hydrogen Market

07:21 – RED ALERT FOR THE NATION’S ELECTRICITY SUPPLY

09:06 – 70% of Passive ESG Funds Are Exposed to New Oil and Gas Projects

12:28 – Markets Update

13:04 – Oil slips as investors weigh Fed rate decision

13:22 – EIA: US crude inventories down 2.0 million bbl

17:41 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:14] What’s going on, everybody? Welcome into the Thursday, March 21st, 2024 edition of the Daily Energy News Beat stand up. Here are today’s top headlines. First up, energy giants create global synthetic natural gas coalition. Interested to hear that one. Next up Deutschland how Germany is dominating the hydrogen market. Super interesting. Next up guys. Red alert for the nation’s electrical supply. Very interesting and interesting study that’s coming out of the Washington Post of all places. So we’ll we’ll get a crack into that. We will then cover 70% of passive ESG funds are exposed to new oil and gas products. You can only laugh at this one stool. Then toss it over to me. I will quickly cover what’s going on in the oil and gas markets. Touch on crude oil inventories. Which was actually a little bit of a surprise relative to what we saw from the API. And then cover com start getting an investment from a majority shareholder. So, name ring a bell? Jerry Jones. We’ll talk about all that and the bag of chips guys. As always I’m Michael Tanner joined by Stuart Turley. Kick us off. [00:01:25][70.5]

Stuart Turley: [00:01:26] Hey, let’s get ready to rumble here, Michael. Energy giants create global synthetic natural gas coalition. I think we found as a new, investor of the week in, investor relations guy of the week. That title of this thing is very confusing. It is e dash n g. It’s supposed to be. The ESG of ESG is considered as a sustainable drop in solution for gas consumers, as it does not require the modification of industrial processes and application to be used in place of conventional. All right, that sounds pretty good. But they’re looking at the, we have totalEnergy and U.S. Sempra Infrastructure have announced plans to create the coalition and try to work with e natural gas, a synthetic natural gas produced from. Are you ready? Renewable high GNN CEO to. [00:02:33][67.0]

Michael Tanner: [00:02:36] Us. Here’s my big. I have no idea if this technology works, but if it does, it would ng. It’s it’s a great marketing slick. You’re absolutely right. Whoever came up with this, we would collectively give credit to whatever marketing firm came up with that for I our guy of the week. Because you’re right, the energy is great. I think what you love is what’s up I love it. Yeah. I mean I guess. [00:03:00][23.9]

Stuart Turley: [00:03:01] Yeah I it’s not there yet. I mean, this is hilarious the way they’re bringing this coalition together, it’s it’s like, the WEF got together with the WWE and started a little rumble and match. This is a nutty thing. If this will go in line with our next story on the energy thread, but I just found total energy is really pretty interesting. Mitsubishi is in here. [00:03:25][24.6]

Michael Tanner: [00:03:27] They’ll have a suite. This coalition’s going to have a great fundraising campaign. They’re going to raise a lot of money from sponsors. They’re going to have a nice big event out there in DC. Not much will change, though. You’re right, you’re right. Let’s next. [00:03:40][13.4]

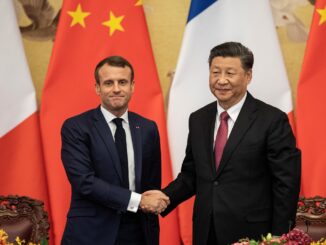

Stuart Turley: [00:03:41] It is pathetic. Let’s go to Deutschland How Germany is dominating the hydrogen market okay. Energy with Germany is kind of a bad thing right now because Germany and California have the two highest energy costs in the world. Both are industrializing because of their energy policies. So let’s start this. If somebody is de industrializing and they’re horrible with decisions, would you want to follow them as an energy lemming? How is Germany dominating the hydrogen market? Question mark. Ten gigawatts of, like, electrolysis lasers are predicted to produce, half a million tons of green hydrogen annually. This investment means it’s set to boast more hydrogen valleys than any other country in the world. France is expected to sit in second place, with four in the UK, and the Netherlands are supposed to have two apiece. It doesn’t work. I almost want to do my Biden imitation. I’m leaning into the mic. It doesn’t work. Where’s the water? Hydrogen takes a lot of water, no matter what process. This is part of the great EU hydrogen corridor that you cannot put these things into a normal pipeline. They say that you can put them in natural gas. And I was big on this. It doesn’t work. It has to be all new pipelines. The cost is prohibitive. [00:05:21][99.9]

Michael Tanner: [00:05:24] Yeah. No, I mean, I. You’re absolutely right. It’s I mean, there’s funding available for it. So people are going to create projects to do that. I do love there in this, this hydrogen core. Do I found that super interesting. Now in in Germany’s defense, they are one of the final high quality manufacturing countries in the world. High precision tools. Their main, their scale manufacturing is one of the best in the world. So if anybody’s going to they were. [00:05:55][31.0]

Stuart Turley: [00:05:56] The operative word is were they? Most high tech folks are leaving and they have quit investing in new technology in Germany. Okay. Words were. [00:06:12][15.8]

Michael Tanner: [00:06:13] Okay. I mean, I still don’t think it’s going to work, but if they if. You can’t get a word in with them. I think in my, you know, you got to try. Now is this a little bit of just a government grab to to to to funnel some money to some other bureaucratic wheel. Probably. But they are actually trying to make it happen again. Is it going to work. I don’t know, but I’m all for private industry doing this. Like BMW goes down to talk about how, BMW is looking and how much they’re spending on trying to get a hydrogen car. I’m all for private industry doing this because that’s the efficient market way. [00:06:51][37.7]

Stuart Turley: [00:06:52] Yep. I agree. I love having profits from companies supported by the market. Get the energy. We’ll see. [00:07:01][8.9]

Michael Tanner: [00:07:01] We’ll see. Just like we’re seeing with wind and solar. We’ll see if it reigns supreme. [00:07:05][3.5]

Stuart Turley: [00:07:06] No. Yeah. Let’s spend some more money. Taxpayers got all of it to give away. Okay, let’s go to the next. [00:07:12][6.2]

Michael Tanner: [00:07:12] Point for private industry. Oh, I’m not for public spending. There’s a difference. [00:07:18][6.1]

Stuart Turley: [00:07:19] A huge difference. Red alert for the nation’s electric supply. This is pretty funny. It comes out of the Washington Post ran a front page article March 10th titled, Amid explosive Demand America is Running out of Power. Michael, what’s driving a lot of the new demand? [00:07:42][22.3]

Michael Tanner: [00:07:43] Well, there’s so much there’s AI, there’s data centers. There’s so much driving new energy consumption. It’s as what is the what did Mark Washington both say amid explosive demand? Oh, that’s just that’s that that. Yeah. When I think of explosive, I don’t think of demand. I think of something else. Yeah, yeah. [00:08:05][22.4]

Stuart Turley: [00:08:06] Oh. Okay, I went there. That was horrible. I just I’ve got to go get mental floss now. Then later, lower down in the article here, it says that more than 60% of data centers are expected to locate in miso, caso mostly in California. PJM and neither Miso or Casio appear to have included substantial data center growth in their forecast. But that’ll that’ll get you all right. Pennsylvania is going through the AI data center pain right now. We just we covered some of these stories in the last few weeks. There’s not enough energy in these big data centers. In fact, Facebook is putting one in, and there’s not enough power to even support it. What’s he going to do? Flap his gums and give a speech in there to power it? I don’t know. [00:09:03][56.8]

Michael Tanner: [00:09:03] There’s no way. All right, what’s next? [00:09:05][1.5]

Stuart Turley: [00:09:06] Let’s go to. 70% of passive ESG funds are exposed to the new oil and gas projects. Investing hypocrisy is seeing light at the end of the tunnel. A total of 70% of passing funds passed off as sustainable by five of the largest asset managers in the U.S. and Europe are exposed to companies developing new oil and gas projects. It’s pretty funny. We saw this with Blackrock last year sneaking in pipelines that they had actually owned in the Middle East and kept hidden on their balance sheet. Now, Texas just shut down the $8 billion that they are investing. [00:09:54][47.6]

Michael Tanner: [00:09:54] Texas is a black. [00:09:56][1.8]

Stuart Turley: [00:09:56] Blackrock and they’ve shut that down today and it is now out. So that was yesterday, I believe. Here’s a quote. The authors of the Reclaim Finance’s report wrote the analyst also shows that, especially when these funds are invested in bonds, they provide direct financing for fossil fuel developers. Well. [00:10:23][26.5]

Michael Tanner: [00:10:24] Well, I think what’s interesting is so they, they they took 430, quote, sustainable passive funds managed by the five largest fund managers. You’ve got, legal and general investments, ABS investments, Blackrock, DWS and Dotti. And 70% of the 430 funds were exposed to companies that are actually developing, fossil fuel projects. Not only, you know, some of the biggest is TotalEnergies, which you could argue was trying to go ESG, but it really hasn’t. We just saw that yesterday with the non op deal shell Exxon. But get this also for developers like Glencore you know who’s you know which I’m all for again make coal great again I’m I’m all for it. [00:11:09][44.3]

Stuart Turley: [00:11:09] did you just say coal. [00:11:10][0.9]

Michael Tanner: [00:11:11] I did. [00:11:11][0.2]

Stuart Turley: [00:11:12] Oh man. Don’t you know. [00:11:14][2.3]

Michael Tanner: [00:11:15] Now? [00:11:15][0.0]

Stuart Turley: [00:11:15] Oh, no. There’s a pow pow pow pow pow. There’s all those left wing nut job heads going off right now. POW pow pow. [00:11:23][7.4]

Michael Tanner: [00:11:23] Pow. So? [00:11:24][0.5]

Stuart Turley: [00:11:25] So you’re on the podcast now, Karen? No, sorry. [00:11:32][7.5]

Michael Tanner: [00:11:32] It’s crazy. It’s crazy. [00:11:33][1.0]

Stuart Turley: [00:11:34] All right, man, after, you know. Yeah. [00:11:36][2.0]

Michael Tanner: [00:11:37] We’ll we’ll quickly cover here. What’s going on? Oil and gas. Finance guys. But but first we’ll go ahead and pay the bills or attempt to after that. Appreciate everybody who tunes in. Thanks for again. All this stuff is brought to you by Energy News Beat.com The best place for all of your energy and oil and gas news to join the team. Do a tremendous job making sure that website stays up to speed. Everything you need to know to be the tip of the spear when it comes to the energy business. Check out the description below for all the timestamps links to the different articles. And check out, the survey we have running below. You can also hit us at dashboard.energynewsbeat.com Youtube.com, which is the best place for all your data news combo. But to get that while you still can, because, you never know where it might go again. Energynewsbeat.com [00:12:25][48.0]

[00:12:28] I mean, really, when we look at the overall markets today, we saw the S&P 500 up about 8/10 of a percentage point. Nasdaq traded up about 1.15 percentage points, mainly off the back of India continuing to just absolutely carry the economy. the moves are absolutely insane. Dollar index down about half a percentage point. Bitcoin with a little bit of a rebound up to $67,000 today. That’s up about nine percentage points in a 24 hour span. Crude oil is you know basically stayed flat 8150 8636 for Brant natural gas trading at $1.70 that we had a couple issues. We’ve got, you know, you know, the feds came out today and decided to hold U.S interest rates steady. You know, that was a talk that they were going to cut. They’ve already we’ve projected a few cuts in. They didn’t raise. They held firm. So that guidance didn’t necessarily do more or less for oil. It kind of held it flat. We did see an expected 2 million barrel draw from the EIA crude oil trolling reserves. It was again 2 million. And the current levels are sitting at 445, 445 million barrels of crude oil inventories, just about 3% below that five year average. We also saw total motor gasoline inventories decreased by 3.3 million, and are about 2% below the five year average. We also saw, refining output, averaged about 15.8 million barrels per day for the week, which was about 125,000 barrels more than the previous week. You’re sitting at about an 87.9% refinery capacity. So there’s a little bit of wiggle room. To grow up there, but we’re starting to get it up there. You know, I really think there’s there’s there’s only one thing I saw. And this came across late due this was a late waiver wire from stock Resources announces $405 million investment by majority shareholder Comstock resources out of Frisco. There announces that it’s majority shareholder, our friend Jerry Jones. Not really a friend. I don’t know why I said that, but, has agreed to make a $100.45 million equity investment into the company through multiple entities that he controls. He’s going to acquire about 12.5 million shares of common stock in a private placement, at about $8 a share, which represents the average closing price for the five, trading days leading up to that. He’s going to remember he’s going to own about 67% of the company’s shares outstanding after this commitment is done, up from 65, who’s buying about 2% of the company or $100 million, which is kind of crazy to think about it. Who percent for $100 million to good deal. It’s a good deal for Comstock. You better. You’re lucky your own. I mean, it’s Jerry buying his own stuff, but it’s a little crazy to think about. You know, the that valuation there. They came out and said they’re going to use the proceeds from the equity investment to pay down bank debt, which was partially incurred to fund, their most recent acquisitions, which is a bunch of Western Haynesville stuff for about 58 million from a variety of people. So, nothing like buying low and sell or, selling low and buying high. Gotta love it. Buying natural gas assets and then they tank on you. That’s got to suck. But good for Jerry. I mean, will this work out? Only time will tell. I’m gonna. I’m gonna go out on a limb and say Comstock’s probably in rough shape. If there needed to go $100 million to Jerry, and he’s willing to only do that for 2%. I mean, that’s yikes. You know what I mean? [00:15:59][210.6]

Stuart Turley: [00:15:59] I wonder, how that transaction’s going to happen if he’s investing in getting a tax deduction. Because if it’s a public company, you’re not able to take some of that deduction off. [00:16:11][11.8]

Michael Tanner: [00:16:12] It’s these two entities that he controls. So it’d be interesting what these entities are. They’re not businesses. They’re probably they’re you wonder if it’s a way to if it’s you know obviously he’s making the majority of his money from the Dallas Cowboys. So the question is is this are these entities the the the vehicles in which the distributions from the NFL are being distributed into these entities? And in order to make those investments liquid, he trades them out for stock at a crazy valuation so that he can then take those shares and get a loan off of them. So he’s liquid. I don’t know, maybe that’s what it is. [00:16:45][33.5]

Stuart Turley: [00:16:46] If it is, that goes back to like the oxy that deal. Well, we were looking to you look under the hood or used to under the skirt when I was in college, you know, you’d say, hey, what’s going on? [00:16:57][11.0]

Michael Tanner: [00:16:58] Well, I mean, this is a it’s one it’s an issue with being an asset heavy in cash light is you have to figure out a way to access your equity in forms of cash. And a lot of what these high net worth people do is they, they acquire stock. And instead of it’s like, why is Elon Musk have a net worth of 100 billion? He didn’t have 100 billion in cash. He has stock worth it. So he goes out and he uses his stock as collateral and gets very low interest rate loans for $1 billion. And now he’s got cash. He still owns the stock but it’s collateralized back. So it’s it’s an interesting it’s an interesting player. Don’t know what’s going in here. But Jerry Jones another 100 million into Comstock. So, you drill baby. Drill. We gotta love it. Gotta go. What else you need? [00:17:42][43.9]

Stuart Turley: [00:17:42] Oh. Not much. We just released, doomberg yesterday. Doomberg and Chris. Right? Yes. And we talked about Liberty’s humanitarian efforts with energy. We talked about Doomberg leadership in finance and energy. It was a fantastic discussion. [00:18:01][18.5]

Michael Tanner: [00:18:02] Yes. Check that out on energy. Newsbeat.com will make sure that sitting on the top news in the and the the the indie publisher’s picks. We always appreciate and Jack thank you Chris. Right and Duma we love them. [00:18:13][10.9]

Stuart Turley: [00:18:13] We love them. And tomorrow is Robert Briggs. Yeah we love us tomorrow. Love. Right. All right. [00:18:23][9.5]

Michael Tanner: [00:18:23] Absolutely. Yeah. So you get Robert Bryce tomorrow, you hear the weekly recap on Saturday, and we will be back in the saddle on Monday. We’ll probably drop a podcast. Just an interview. You got somebody to drop on Sunday? [00:18:35][11.9]

Stuart Turley: [00:18:36] I do, I do. Let me look, let me look. Give me a second look at. [00:18:41][5.2]

Michael Tanner: [00:18:41] The production calendar. [00:18:42][0.5]

Stuart Turley: [00:18:43] I’m looking at production. We have Irene, a slob on deck. This one’s going to be pretty good. And then we also have Gifford Briggs, Gulf Coast director for the API. And then we have JT coming around the corner. You talk with JT. [00:18:58][14.8]

Michael Tanner: [00:18:59] I’m talking with JT. I’ve got two spotlights that I’m about to record. one being on the court. Merger, and then another one specifically on, the ICT equity. We’re bringing in JT he’s, a recent friend of the show, but we’ve got to know each other a little bit. He’s a midstream M&A guy. He’s going to kind of talk us through what this all means. He’s a big fan of Toby Rice, so, I’m sure he’ll he’ll love this deal. But it will be interesting because that stock price doesn’t look good. But with that guys we’re going to let you get out of here. Appreciate you checking us out. As always. You’ll check out Robert Bryce tomorrow on the podcast. Check out the weekly recap on Saturday, and we will see you back on Monday. Have a great weekend, folks. [00:18:59][0.0][1083.8]

– Get in Contact With The Show –