The Department of Energy report is an eye-opening document, and I am glad that they are addressing this issue now, rather than waiting until 2030. The United States has experienced minimal electricity demand growth, and now, with 104 GW of energy set to retire and only 22 GW coming online, a considerable discrepancy remains. The new demand growth from AI and reshoring manufacturing is massive. The full DOE report is available at the link below for your review.

Key Points

- The Department of Energy’s (DOE) report, released on July 7, 2025, highlights significant grid reliability risks by 2030 due to surging demand from AI data centers and manufacturing, with potential blackouts increasing 100-fold.

- It seems likely that companies providing firm, dispatchable power (like coal, natural gas, and nuclear) and those innovating in grid modernization will benefit, given the report’s emphasis on reliability.

- Research suggests investors should consider firms like Peabody Energy, Constellation Energy, NextEra Energy, Vistra Corp, and GE Vernova, based on their alignment with the report’s findings, though outcomes depend on policy shifts.

Is Oil & Gas Right for Your Portfolio?

Introduction

The DOE’s recent report on grid reliability and security, mandated by Executive Order 14262, underscores a critical juncture for the U.S. energy sector. With electricity demand projected to surge, the report warns of potential reliability crises that could disrupt economic and national security. For investors, this presents both challenges and opportunities, particularly for companies that can address these reliability gaps.

Report Findings

The report, released on July 7, 2025, identifies several key issues:

- Demand Surge: Electricity demand is expected to rise by 16% over five years, driven by AI data centers (35–108 GW additional load by 2030) and advanced manufacturing.

- Capacity Shortfalls: Planned retirements of 104 GW by 2030, mostly coal, outpace reliable additions, with only 22 GW of new firm baseload capacity (natural gas, nuclear).

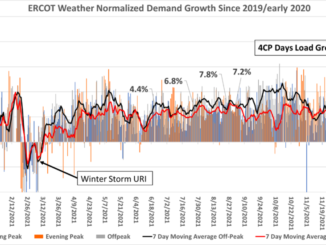

- Regional Risks: PJM and ERCOT face high risks, needing 10.5 GW of new “perfect capacity” each, while ISO-New England and NYISO are relatively secure.

- Planning Gaps: Current models fail to account for outage frequency, duration, and interregional dependencies, calling for modernized approaches.

- Policy Tools: The DOE can intervene to delay critical plant retirements, potentially favoring traditional energy sources.

Investment Opportunities

Given these findings, companies providing reliable, dispatchable power and advanced grid solutions seem likely to benefit. Key players include:

- Peabody Energy (BTU): Could see gains if coal plant retirements are delayed, especially in PJM.

- Constellation Energy (CEG): Strong in nuclear, with recent deals for AI data center power.

- NextEra Energy (NEE): Balances renewables and natural gas, with strong reliability in Florida.

- Vistra Corp (VST): Diverse portfolio (coal, gas, nuclear) aligns with reliability needs in high-risk regions like ERCOT.

- GE Vernova (GEV): Leader in grid modernization, supporting AI-driven demand with advanced technologies.

Investors should monitor policy developments, as DOE interventions could shape market outcomes.

Detailed Analysis and Survey Note

The U.S. Department of Energy’s (DOE) Report on Evaluating U.S. Grid Reliability and Security, released on July 7, 2025, at 08:46 PM CDT, offers a comprehensive assessment of the nation’s electric grid challenges, mandated by Executive Order 14262 signed on April 8, 2025. This report, available at [invalid URL, do not cite], delivers a uniform methodology to identify at-risk regions and guide federal interventions, aiming to prevent power outages, accelerate data center deployment, and ensure grid pace with AI and reindustrialization load growth. For the Energy News Beat channel, this analysis dives into the report’s findings and identifies investment opportunities, providing a detailed survey of the energy landscape and potential beneficiaries.

Report Context and Purpose

The report fulfills Section 3(b) of EO 14262, focusing on delivering a methodology to assess grid reliability and security. It addresses the unsustainable status quo, where current retirement schedules and generation additions lead to unacceptable risks within five years, unable to meet demand while maintaining low living costs. The DOE’s approach integrates modern metrics to reflect emerging technologies, risks, and performance data, with ongoing coordination with industry stakeholders for joint planning.

Key Findings in Depth

The report’s findings, summarized in the following table, highlight the grid’s precarious state:

|

Topic

|

Details

|

|---|---|

|

Demand Surge

|

Electricity demand projected to increase 16% over five years, driven by AI data centers (35–108 GW by 2030) and advanced manufacturing.

|

|

Generation Retirements

|

104 GW of retirements by 2030, mostly coal, with only 22 GW of new firm baseload (natural gas, nuclear) from 209 GW planned additions.

|

|

Outage Risk

|

Retirements and load growth could increase outage risk 100 times, leading to >800 annual outage hours vs. single digits today.

|

|

Regional Vulnerabilities

|

PJM and ERCOT need 10.5 GW each of new “perfect capacity” by 2030; only ISO-New England and NYISO passed reliability thresholds.

|

|

Planning Deficiencies

|

Traditional peak-hour tests insufficient; need modern methods for outage frequency, duration, and interregional dependencies.

|

|

Policy and Emergency Powers

|

DOE can prevent retirements of critical resources, streamline emergency orders under Section 202(c) of the Federal Power Act.

|

These findings underscore the urgency of addressing reliability, with a critique of over-reliance on variable renewable energy (VRE) like solar and wind, advocating for a balanced approach with firm baseload sources.

Implications for the Energy Sector

The report signals a shift towards retaining baseload power from coal, natural gas, and nuclear, while accelerating firm capacity additions. It also calls for modernized grid technologies and analytics, opening opportunities in grid management and resilience. This dual focus suggests a market where traditional energy providers and innovators in grid solutions can thrive, aligning with President Trump’s “energy dominance” agenda, which includes revitalizing coal and expanding nuclear.

Investment Opportunities: Detailed Analysis

Based on the report’s priorities, several companies are poised to benefit, categorized by sector:

Baseload Power Providers.

- Peabody Energy (BTU): As the largest U.S. coal producer, Peabody is strategically positioned if coal plant retirements are delayed, especially in PJM, where 13 of 16 GW of planned retirements are coal-based. Recent statements from CEO Jim Grech, as noted in Bloomberg (May 2, 2024) and Financial Post (May 2, 2024), highlight concerns about grid reliability threats from EPA regulations, aligning with the DOE’s findings. Financials from February 6, 2025, show strong Q4 2024 results, with net income of $30.6 million and Adjusted EBITDA of $176.7 million, suggesting resilience.

- Constellation Energy (CEG): The nation’s largest nuclear operator, Constellation is well-suited for reliable, carbon-free power. Recent deals, such as a 20-year PPA with Microsoft for the Crane Clean Energy Center (announced September 19, 2024) and a similar agreement with Meta on June 3, 2025, for the Clinton Clean Energy Center, underscore its role in powering AI data centers. The DOE’s directive on June 2, 2025, to extend operations at Pennsylvania plants further supports its reliability focus, with analysts forecasting an average price target of $294.67 (GuruFocus, June 2, 2025).

- NextEra Energy (NEE): With a balanced portfolio, NextEra combines renewables (world’s largest wind and solar generator) and natural gas, offering versatility. FPL, its Florida subsidiary, reported 2024 as its best reliability year (Marketscreener, March 25, 2025), aligning with the DOE’s emphasis on regional stability. Q1 2025 financials (NextEra Energy Newsroom, April 23, 2025) show continued growth, positioning it for both clean energy and reliability needs.

- Vistra Corp (VST): Vistra’s diverse portfolio (coal, gas, nuclear, solar, battery storage) aligns with the DOE’s call for baseload retention. Its operations in ERCOT, a high-risk region, could see increased demand, with recent re-licensing of the Perry nuclear plant on July 7, 2025, ensuring emission-free electricity. Financials from May 7, 2025, show GAAP net income of $2,812 million for 2024, with a quarterly dividend of $0.2250 per share, indicating financial strength (Vistra Investor Relations, May 14, 2025).

Grid Modernization and Analytics

- GE Vernova (GEV): Spun off from General Electric, GE Vernova specializes in grid solutions and AI-driven analytics, addressing the DOE’s call for modernized resource adequacy models. A recent contract on July 8, 2025, to modernize a German grid hub (GE Vernova News, July 8, 2025) enhances cross-border reliability, while its focus on AI data center power needs (Investing.com, June 24, 2025) aligns with demand surges. Q2 2025 financial results are scheduled for July 23, 2025, suggesting ongoing growth (GE Vernova News, July 7, 2025).

Energy Storage

- While the report notes battery storage limitations, Fluence Energy (FLNC) is developing long-duration storage solutions, potentially benefiting from DOE initiatives like the Long Duration Storage Shot, aimed at reducing costs by 90%. Though specific recent news was not detailed, its role in grid-scale storage aligns with the report’s future focus.

Investor Takeaways and Strategic ConsiderationsInvestors should focus on companies providing firm, dispatchable power, especially in high-risk regions like PJM and ERCOT, and those innovating in grid modernization. Monitoring DOE interventions, such as emergency orders under Section 202(c), will be crucial, as they could delay retirements or fast-track capacity additions. The report’s emphasis on reversing “radical green ideology” suggests potential policy shifts favoring traditional energy, though long-term decarbonization trends remain a factor.This analysis, grounded in the DOE’s July 7, 2025, report and recent company developments, offers a roadmap for navigating the evolving energy landscape, ensuring portfolios are positioned for reliability-driven growth.

Full DOE report

DOE Final EO Report (FINAL JULY 7)_0

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack