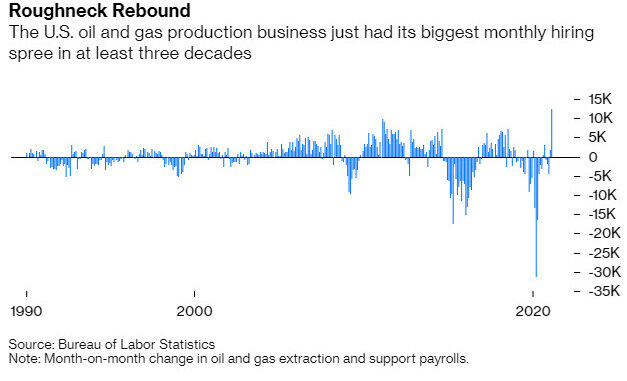

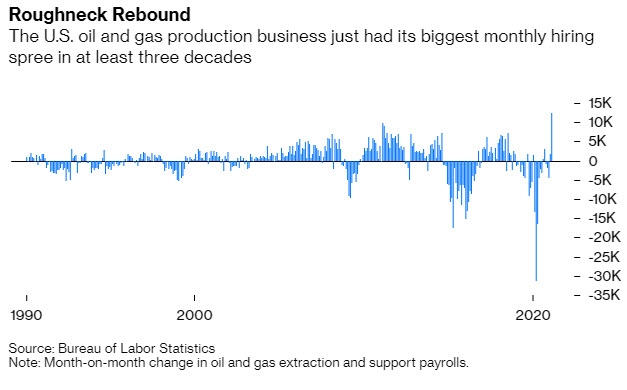

Friday’s jobs numbers threw everyone for a loop. But they were unambiguously good for the oil and gas business: Payrolls jumped by more than 12,000 in March, the biggest monthly gain in more than 30 years of data. 1

This is the season for big comebacks; it’s only just over a year since crude oil posted negative prices on Nymex. For the benighted E&P sector, though, this rebound depends a lot on restraint; around spending and growth, chiefly.

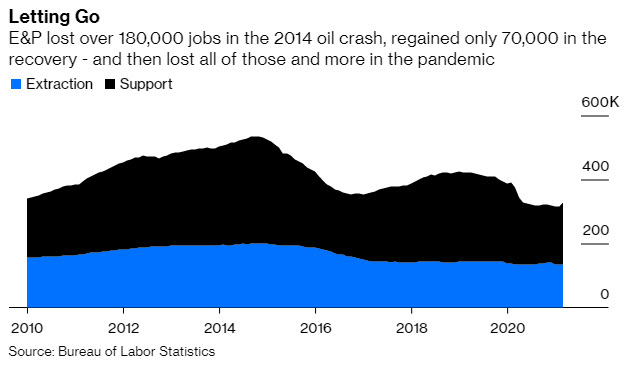

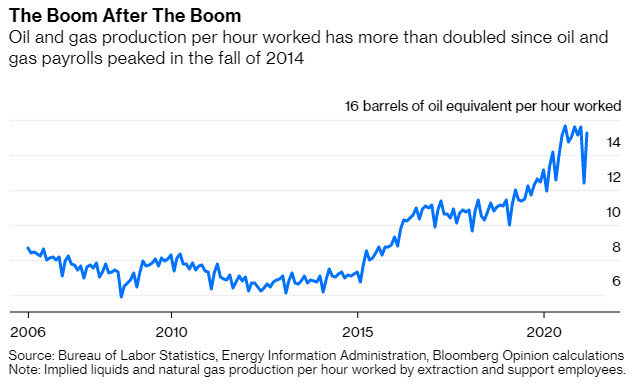

The industry’s ranks are 207,000, or almost 40%, lighter than at their peak in September 2014. But output is up by almost a third. The productivity gains seen in the past year were just the latest phase of a process that got going when the shale-oil boom hit its first bust almost seven years ago.

Pair those efficiency gains with a rally in oil and gas prices, and you’ve suddenly got a much more profitable business. Multiplying output by benchmark crude oil, natural gas and natural-gas liquids yields a proxy for industry revenue running at about $33 billion a month so far in 2021. That’s on a par with late 2019 — but with far fewer workers on the payroll. Despite March being the biggest month for hiring in decades, the implied share of revenue taken by wages fell below 7% for the first time since the spring of 2011.

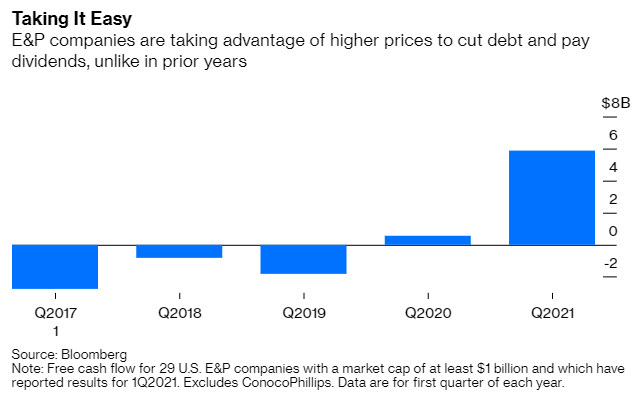

After the tumult of 2021, the industry now finds itself at a point of equilibrium. Oil and gas prices have recovered to a level that previously presaged a big rebound in fracking. Yet the mood music thus far in earnings season has been notably, and thankfully, subdued. Free cash flow has soared.

The drop in the wage burden and likelihood that oil prices strengthen into summer (or at least don’t weaken) means frackers have some room for hiring and putting rigs and completion crews back to work. As I wrote here, though, having been rerated already, E&P stocks now rely on a mix of rising earnings and being boring to maintain the rally. March was a welcome sign of recovery from a crisis, but it can’t be the new norm.

by Liam Denning