There are currently millions of Texans wondering what the **** happened to the power grid this week. Across Enverus’ Texas workforce, hundreds of us were impacted and want to know what went wrong, too.

In a world of overflowing opinions and speculations on what caused the massive failure to ERCOT’s supply, we want to provide a full explanation of what unfolded from the power market and trading perspective.

Starting with a broad overview from the PUCT, here’s a recap of what happened leading up to the widespread power outages:

“The Polar Vortex unleashed a polar airmass that has settled on much of the Nation and has brought historically low temperatures to Texas. This frigid airmass, in combination with other weather systems, has produced historically low temperatures, ice storms, and record snow falls. Governor Greg Abbott on February 12, 2021 certified that this severe winter weather poses an imminent threat of widespread and sever property damage, injury, and loss of life due to prolonged freezing temperature, heavy snow, and freezing rain statewide. To address this threat, the Governor Abbott declared a state of disaster in all 254 counties of Texas and suspended upon his approval regulatory matters that would hinder or delay necessary action to cope with this disaster. These severe weather events and other events have affected many things, including the wholesale price of electricity and the price of natural gas, a major fuel for electric generation. The effect has been curtailments of the electric-generation fleets committed to the electricity market in the region of the Electric Reliability Council of Texas (ERCOT). The lack of sufficient generation resources caused ERCOT to issue an Emergency Energy Alert 3, which resulting in the shedding of customer load.”

ERCOT Power Grid Issue 1: Gas Supply Prior to the Event

-

Going into the weekend, spot gas prices rose to historic levels due to pipeline transport limitations due to cold temperatures, icy roads in the Permian Basin, freeze-offs impacting producing wells and midstream infrastructure, and power outages impacting infrastructure facilities.

-

This caused the marginal price of energy to increase to extremely high levels on Saturday and Sunday across the US. For ERCOT a $150/MMBtu spot Houston gas with the typical marginal heat-rate for this time of year of 9.2, price power at $1,380/MWh. This is without scarcity pricing adders from the ORDC. Gas prices reached several hundred dollars and topped out at $999 for certain locations in the cash market during this event, according to NGI.

-

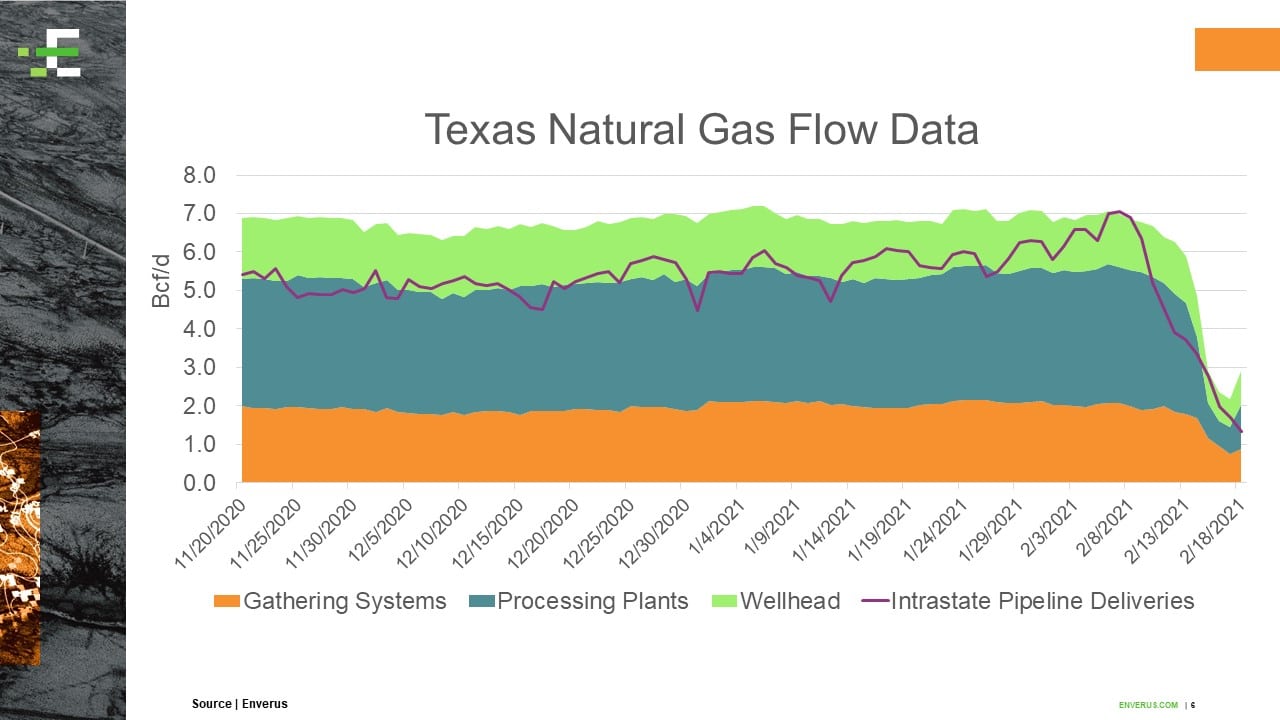

The natural gas pipeline flow data has dropped about 4.6 Bcf/d over the past several days. Our data sample for Texas dropped from ~7 Bcf/d to 2 Bcf/d at the peak, and there was likely more gas offline on the intrastate pipelines that we can’t isolate to supply outages yet. We included the data from intrastate deliveries onto interstate systems in the chart below, but some of that gas may be redundant flow (captured in the rest of the chart) or gas staying in Texas that would normally be delivered downstream. Gas supply rebounded a 0.70 Bcf/d on 02/18 from the low point on 02/17.

ERCOT Power Grid Issue 2: Outages

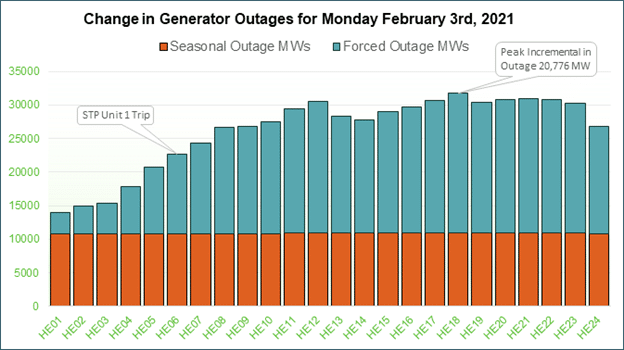

Outages: The major cause is lack of supply due to plants in seasonal maintenance outage, low renewable production, and forced outages of available units due to freezing conditions.

- ERCOT spring outage season was well underway and seasonal maintenance outages were reportedly just over 13.5GW on February 14, 2021 01:00.

- Enverus renewable forecasts anticipated very weak produc

tion for the next several days. Although wind over-produced the forecasts early in the day on Monday, the actualized production was still an anemic 3GW around-the-clock. Similarly, solar suffered from very cloudy conditions across the system. - Beginning the evening of Sunday February 14, 2021, power plants of all fuel types (renewable, coal, natural gas, and nuclear) began tripping off-line into forced outage. At the event peak on Monday over 20GW had tripped offline.

- South Texas Project Nuclear Unit 1

- NRC Report commentary ”At 0526 [CST] on 02/15/2021, Unit 1 automatically tripped due to low steam generator levels.”

- The cause was reported to be inlet water failure due to freezing of several feedwater pumps.

- Commentary on the other fuel type failures

- The primary causes for thermal unit trips during the last winter emergency event in February 2011 was freezing of water supply (feedwater pumps) and cooling tower sensors freezing causing automatic system shutdowns. These are likely the main causes for failures in this event as well.

- South Texas Project Nuclear Unit 1

ERCOT Power Grid Issue 3: Load (Historically High Demand Event)

Load: A week in advance, Enverus reported to our customers the risk of historically high demand for this event, exceeding the previous winter peak and possibly near summer peak levels. We warned of freezing turbine blades at windfarms, as well as risks of thermal unit failures due to the temperatures. We gave an open webinar on February 12 highlighting the potential risks of situation.

- ERCOT’s previous all-time winter peak demand record was set on Jan. 17, 2018, when demand reached 65,915 MW between 7 and 8 a.m.

- Due to successive EEA event declarations, demand was not able to reach forecasted levels.

- “EEA Level 1: At 00:15, ERCOT at EEA 1 – Reserves below 2, 300 MW. No rotating outages at this time.”

- “EEA Level 2: At 01:07, ERCOT at EEA 2 – Reserves below 1, 750 MW. Load resources are being deployed. There may be a need to implement rotating outages. ERCOT is urging consumers and businesses to reduce electricity usage.”

- “EEA Level 3 With Firm Load Shed: At 01:20, Rotating outages are in progress to maintain frequency. ERCOT is asking consumers and businesses to reduce electricity use.”

ERCOT Power Grid Issue 4: Congestion

Complicating Factors in Restoration

The issue throughout this week has been the lack of generating supply. On Monday, some of the units that initially tripped were able to return to service within 24 hours. However, a large portion of thermal generators would not become available until Wednesday morning.

During the time between Monday and Wednesday, ERCOT attempted to return as many customers as possible. ERCOT continuously worked to add meters only to have to cut them again later in the day for system stability. They contended with low operating reserves, frequency oscillations, and voltage issues from plants attempted to return to service, as well as variable supply from renewable generation.

The fact that the ERCOT operators made the quick call to enter EEA3 operations and shed load when they did, kept the ERCOT grid from a blackout. These operators are the unsung heroes. If a blackout had occurred, it would likely have taken SEVERAL MONTHS to return service to the entire ERCOT footprint.

How did this happen?

A similar event happened during the first week of February 2011. Temperature was anticipated to be near historic lows with strong forecasted demand. During the late hours of February 2, thermal powerplants tripped offline in masse due to the temperatures, causing ERCOT to shed load in an EEA3 emergency.

After the event, regulators required that power plants prepare formal winterization procedures as well as reviewing these procedures on a regular basis.

One of the major factors that separates weatherized plants outside of the southern regions of the country is that the turbines are generally not housed inside a building and are exposed to the elements. This is due to ERCOT being a summer optimized market. Building structures around these turbines would generally cause a loss of heat-rate optimization and total output capabilities during the summer. In fact, cold temperatures are usually of benefit to the Texas thermal generating units’ efficiency.

Additionally, the Texas wind fleet is optimized for the warmer climates as it is rarely cold enough to become an issue. Typically, they do not have anti-icing technology that is seen in colder climates.

Finally, ERCOT has a very small but growing solar fleet which under cloudy conditions was not a major factor in providing capacity through this event.

We are discussing these issues and more on Monday, February 22, 2021, for a live web discussion on the event. Sign up here!