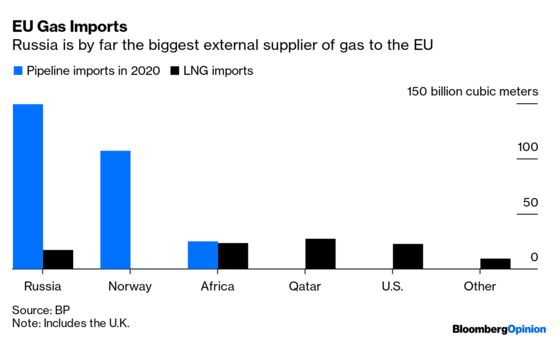

Europe subcontracted its energy security to President Vladimir Putin — now it’s paying the price.

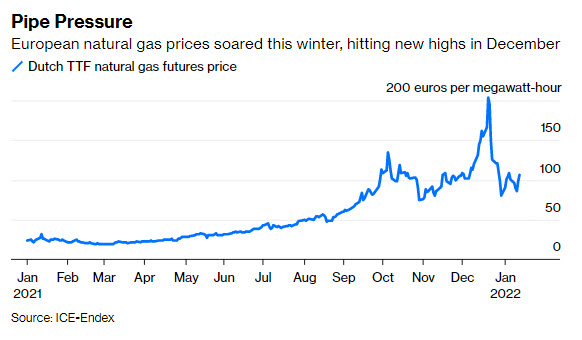

If European energy regulators learn any lesson from this winter’s soaring gas and electricity prices, it ought to be that they need a new set of rules governing gas storage ahead of the cold winter months.

It seemed like such a good idea allowing Gazprom PJSC — Europe’s major gas supplier — to buy up storage facilities close to its customers. After all, Russia has been a reliable supplier of gas to Europe since the 1960s, with flows of the vital winter heating and power generation fuel largely untroubled by the Cold War, the breakup of the Soviet Union and the subsequent reassertion by Russia of its superpower status.

Russian gas flows to Europe haven’t been curtailed by the northern migration of its gas production heartland to the Yamal Peninsula, the emergence of China as a major new destination for export pipelines, nor the Kremlin’s 30-year policy of cutting transit countries — like Belarus, Poland, Ukraine, and the Baltic states — out of its oil and gas export routes.

By selling gas storage sites to Gazprom, European consumers retained the comfort of a large store of readily available fuel on their doorstep without distribution companies and utilities having to actually buy the gas until they needed it.

The European utilities were very happy to let Gazprom incur the financial cost of buying the gas and storing it, often in what are called backwardated markets — where future prices are lower than current ones — when there wasn’t any money to be made in storage. But the very same utilities are crying today about the lack of gas.

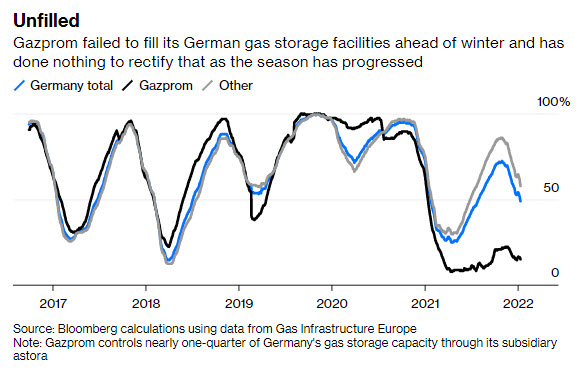

The system works just fine, as long as the storage facilities are filled before the cold weather comes. This winter, they weren’t. And the reason is clear: Gazprom, which controls nearly one-quarter of Germany’s gas storage capacity through astora GmbH, failed to fill its storage caverns.

For consumers, the fact that storage caverns were left unfilled is more important than the reason behind it. European utilities weren’t in any rush to lease storage space and Gazprom either couldn’t, or wouldn’t, fill the storage it owns. Whatever the cause, the result for consumers is the same: fears of shortages and skyrocketing prices.

Russia has suddenly become an unreliable supplier. But the fact that Europe never insisted on minimum inventory levels for foreign entities — or domestic ones — owning storage facilities is perplexing.

If Europe is going to allow important gas storage facilities to remain in the hands of a trade partner controlled by a foreign government that may not always wish it well, it needs to take concrete steps to ensure that the low inventory levels at the start of this winter aren’t repeated.

To be clear, Europe’s gas storage capacity is adequate … it just needs to be filled. Ownership of gas storage facilities in Europe ought to come with an obligation to fill them ahead of winter, backed up by legal sanction if they aren’t.

Failure to address the issue will leave Europe hostage to the political aims of its biggest supplier — and winter weather won’t always be on its side.