How The U.S. Became A Natural Gas Giant

From a position of relative obscurity less than a decade ago, U.S. natural gas and liquefied natural gas (LNG) export capacity has expanded rapidly since the Lower 48 states first began exporting LNG in 2016. Last year, the United States achieved an important milestone after becoming the world’s biggest LNG exporter, surpassing Qatar and Australia as Europe scrambled to replace Russian gas. This was made possible after LNG liquefaction units, called trains, at Sabine Pass and Calcasieu Pass in Louisiana came online last year.

Last year, U.S. exports of liquefied natural gas (LNG) averaged 10.6 billion cubic feet per day (Bcf/d) , increasing by 9% (0.8 Bcf/d) compared with 2021. LNG exports to Europe increased a torrid 141% clip, or 4.0 Bcf/d, compared with 2021. Europe has become the primary destination for U.S. LNG exports, accounting for 64% (6.8 Bcf/d) of total exports in 2022. Just four countries- the U.K., France, Spain, and the Netherlands-accounted for nearly three quarters of LNG exports to Europe. Europe was able to avoid a gas shortage crisis this winter thanks to high LNG imports.

That’s a really strange turn of events considering that a decade and a half ago, before the shale revolution was a thing, the United States was widely expected to become a key LNG importer, likely dependent on the Middle East, Russia and North African. But then, the shale revolution happened, leading to a massive increase in gas output through the use of horizontal drilling and hydraulic fracturing to extract hydrocarbons trapped in shale rocks. After a decade of dramatic growth and rapid expansion of LNG export facilities, the country began exporting LNG from the Lower 48 states in February 2016.

The U.S. now exports LNG to 40 countries across the globe.

To secure supplies, customers have been signing long-term deals with U.S. producers at a record clip. Last year, the volume of long-term LNG contracts signed to end-user markets climbed to a 5-year high, and the momentum remains strong.

Last year, LNG giant Cheniere Energy Inc.(NYSE: LNG) revealed that it’s had the most active year for contracting since 2011.

Louisiana-based LNG company Sempra Infrastructure, a majority owned subsidiary of Sempra Energy (NYSE: SRE) (BMV: SRE), inked six long-term contracts in the space of just five months. The deal calls for Sempra Infrastructure’s Cameron LNG in Hackberry to supply 2 million metric tons of LNG annually to the Polish Oil & Gas Co. Sempra Infrastructure struck another 2 million-ton deal with Polish for its upcoming Port Arthur LNG facility in Port Arthur, Texas.

Most new contracts are from U.S. supply as operators move projects forward. All these contracts are linked to North American prices. Meanwhile, Chinese buyers continue to dominate the market, signing more than 8 million tpy of new LNG sale and purchase agreements this year.

“The Russian invasion of Ukraine has had a dramatic impact on long-term LNG contracts. Many traditional LNG buyers will neither procure spot gas or LNG nor renew or sign additional LNG contracts with Russian sellers. Spot prices have also been high and volatile, pushing many buyers towards long-term contracts. Additionally, some buyers are returning to long-term contracting on behalf of governments to protect national energy security,” Wood Mackenzie principal analyst Daniel Toleman has said.

Pipeline Bottleneck

Unfortunately, whereas the United States has the world’s largest backlog of near-shovel-ready liquefied natural gas projects, takeaway constraints including limited pipeline capacity remain the biggest hurdle to expanding the sector.

In the Appalachian Basin, the country’s largest gas-producing region churning out more than 35 Bcf/d, environmental groups have repeatedly stopped or slowed down pipeline projects and limited further growth in the Northeast. This leaves the Permian Basin and Haynesville Shale to shoulder much of the growth forecast for LNG exports. Indeed, EQT Corp.(NYSE: EQT) CEO Toby Rice recently acknowledged that Appalachian pipeline capacity has “hit a wall.”

Analysts at East Daley Capital Inc. have projected that U.S. LNG exports will grow to 26.3 Bcf/d by 2030 from their current level of nearly 13 Bcf/d. For this to happen, the analysts say another 2-4 Bcf/d of takeaway capacity would need to come online between 2026 and 2030 in the Haynesville.

“This assumes significant gas growth from the Permian and other associated gas plays. Any view where oil prices take enough of a dip to slow that activity in the Permian and you’re going to have even more of a call for gas from gassier basins,” the analysts have said.

U.S. Pipeline Companies To Watch

According to FERC, four U.S. LNG projects are currently under construction, another 12 have been approved by federal regulators and four more have been proposed totaling 40 Bcf/d of potential LNG exports.

The pivotal Permian Basin is preparing to unleash a torrent of gas and gas projects to meet exploding LNG and nat. gas demand. Energy Transfer LP (NYSE: ET) is looking to build the next large pipeline to transport natural gas production from the Permian Basin. The company is also working on the Louisiana-based Gulf Run pipeline, which will transport gas from the Haynesville Shale in Texas, Arkansas, and Louisiana to the Gulf Coast.

Energy Transfer is expected to report Q2 earnings on 3rd August 2022. The consensus EPS forecast for the quarter, based on 5 analysts as per Zacks Investment Research, is $0.28 compared to $0.20 for last year’s corresponding period.

Back in May, a consortium of oil and natural gas firms namely WhiteWater Midstream LLC, EnLink Midstream (NYSE:ENLC), Devon Energy Corp. (NYSE: DVN) and MPLX LP (NYSE: MPlX) announced that they had reached a final investment decision (FID) to move forward with the construction of the Matterhorn Express Pipeline after having secured sufficient firm transportation agreements with shippers.

The Matterhorn Express Pipeline will transport up to 2.5 billion cubic feet per day of natural gas through approximately 490 miles of 42-inch pipeline from Waha, Texas, to the Katy area near Houston, Texas. Supply will be sourced from multiple upstream connections in the Permian Basin. Matterhorn is expected to be in service in the second half of 2024, pending regulatory approvals.

WhiteWater CEO Christer Rundlof touted the company’s partnership with the three pipeline companies in developing “incremental gas transportation out of the Permian Basin as production continues to grow in West Texas.” Rundlof says Matterhorn will provide “premium market access with superior flexibility for Permian Basin shippers while playing a critical role in minimizing flared volumes.”

Matterhorn joins a growing list of pipeline projects designed to capture growing volumes of Permian supply to send to downstream markets.

WhiteWater revealed plans to expand the Whistler Pipeline’s capacity by about 0.5 Bcf/d, to 2.5 Bcf/d, with three new compressor stations.

MPLX has several other expansion projects under construction. The company says it expects to finish construction on two processing plants this year, and recently reached a final investment decision to expand its Whistler Pipeline.

Also in May, Kinder Morgan Inc. (NYSE: KMI) subsidiary launched an open season to gauge shipper interest in expanding the 2.0 Bcf/d Gulf Coast Express Pipeline (GCX).

Meanwhile, KMI has already completed a binding open season for the Permian Highway Pipeline (PHP), with a foundation shipper already in place for half of the planned 650 MMcf/d expansion capacity.

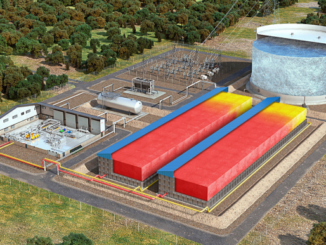

In an effort to increase LNG exports to the European Union to stave off an energy crisis amid Russia’s war on Ukraine, the U.S. Department of Energy has authorized additional LNG exports from the planned Golden Pass LNG Terminal in Texas and the Magnolia LNG Terminal in Louisiana.

Jointly owned by Exxon Mobil (NYSE: XOM) and Qatar Petroleum, the $10B Golden Pass LNG export project is expected to become operational in 2024, while Magnolia LNG, owned by Glenfarne Group, will come online by 2026. The two terminals are expected to produce more than 3B cf/day of natural gas, although Magnolia is yet to sign contracts with customers.

Previously, American LNG developers were unwilling to construct self-financed liquefaction facilities that are not secured by long-term contracts from European countries. However, the Ukraine war has exposed Europe’s soft underbelly and the harsh reality is forcing a rethink of their energy systems. To wit, Germany, Finland, Latvia, and Estonia recently expressed the desire to move forward with new LNG import terminals.

Meanwhile, the DoE has approved expanded permits for Cheniere Energy‘s (NYSE: LNG) Sabine Pass terminal in Louisiana and its Corpus Christi plant in Texas. The approvals allow the terminals to export the equivalent of 0.72 billion cubic feet of LNG per day to any country with which the United States does not have a free trade agreement, including all of Europe. Cheniere says the facilities already are making more gas than is covered by previous export permits.