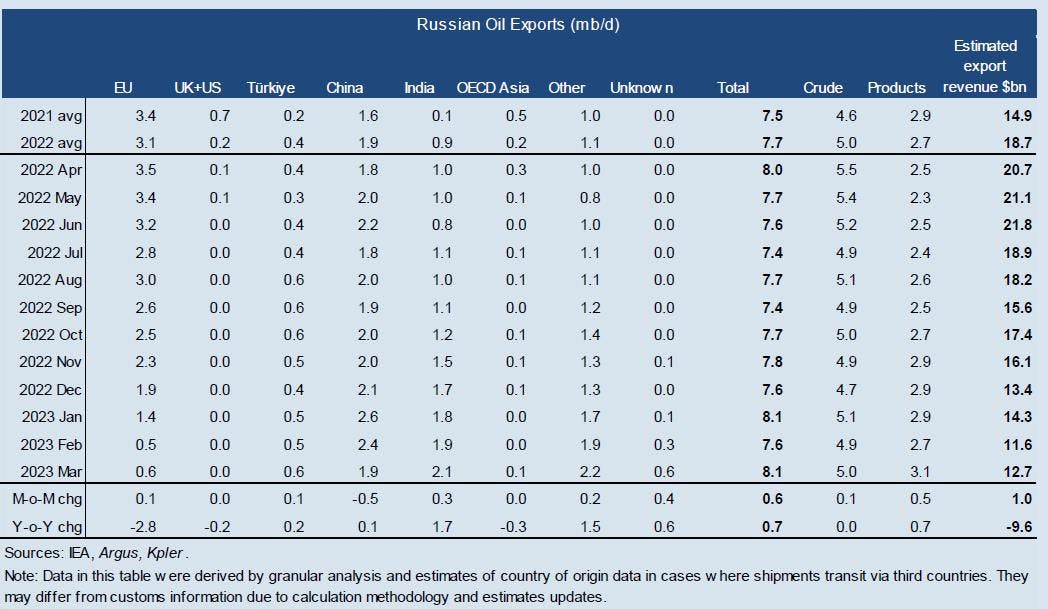

Russia’s oil exports surged in March to their highest level since April 2020 as product flows returned to levels last seen before Russia invaded Ukraine, according to the International Energy Agency (IEA).

Total oil shipments in March increased by 600,000 b/d to 8.1 million b/d, with products climbing 450,000 b/d month-on-month (m-o-m) to 3.1 million b/d. Revenues were estimated to rebound by $1 billion to $12.7 billion but were down 43% from a year ago.

Russian crude oil exports increased by 100,000 b/d in March to 5 million b/d. Shipments to the European Union (EU) continued to decline at a rate of 300,000 b/d. Onshore trade via the Druzhba pipeline was noticeably weaker (230,000 b/d), and pipeline flows are expected to continue to decline as Poland’s largest refiner, PKN Orlen, canceled its contract with Tatneft in early April. Most of Russia’s EU seaborne exports, totaling 110,000 b/d, are destined for Bulgaria, which is exempt from the embargo.

In Asia, top importers switched ranks in March, with India overtaking China as the top importer of Russian crude oil. Exports to India edged up by 200,000 b/d to 2.1 million b/d, while exports to China fell by 500,000 b/d to 1.7 million b/d. Roughly 200,000 b/d of Russian crude oil exports had no known destination at the time writing.

Meanwhile, product exports surged by 450,000 b/d to 3.1 million b/d. Product flows to EU destinations nearly doubled to 300,000 b/d (+140,000 b/d m-o-m), but were down almost 1.5 million b/d compared with pre-war levels. Sales to Türkiye rose 130,000 b/d m-o-m, led by a notable increase in gasoil/diesel shipments to almost 370,000 b/d – the highest level at least since 2018. Other gains came from the Middle East, Africa and Latin America, which rose by 350,000 b/d, 320,000 b/d and 80,000 b/d, respectively, compared with pre-war levels, with nearly 1 million b/d of Russian oil products heading for these three regions in March. At the time of writing by the IEA, roughly 400,000 b/d of Russian product exports had no known destination.