(Bloomberg) – Oil executives are flocking to Venezuela to take advantage of lighter U.S. sanctions, even though there’s a risk that access to the world’s largest oil reserves might snap shut as quickly as it opened.

Source: World Oil

Companies including Shell Plc., Repsol SA, Hungary’s Mol Nyrt, Sweden’s Maha Energy AB, the National Gas Company of Trinidad and Tobago and Bolivia’s state gas company YPFB have sent delegations to Caracas since the U.S. lifted curbs on Venezuela’s oil sector last month, according to four people with knowledge of the situation.

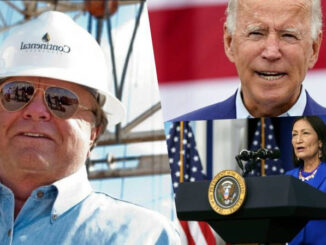

The companies are generally trying either to secure access to oil and gas fields, rewrite contracts or recover old debts, the people said. They are effectively betting that the government of U.S. President Joe Biden won’t follow through on its threat to reimpose sanctions against companies that operate in Venezuela, which would stop the party just as it’s getting started.

Washington gave the government of President Nicolás Maduro until the end of November to make significant advances toward holding fair elections, including defining a process for disqualified candidates to participate in next year’s vote. Maduro has yet to do this, bringing a risk of “snapback sanctions” that would reimpose tight curbs on Venezuela’s oil sector, making it nearly impossible for foreign drillers to operate there.

“If they don’t take the agreed steps, we will remove the licenses we’ve awarded,” U.S. Assistant Secretary of State for Western Hemisphere Affairs Brian Nichols said this month.

However, the U.S. may be reluctant to reimpose controls. A revival of Venezuela’s oil sector helps offset the impact on oil markets of sanctions imposed on Russia last year, while a stronger Venezuelan economy also helps curb the flow of migrants to the U.S.

Sudden decision. In recent weeks, foreign oil executives have met officials from the oil ministry, state-controlled oil company Petróleos de Venezuela SA, or PDVSA, and the International Investment Center, a government-led investment promotion entity, the people said.

The scope of the Biden administration’s decision to ease controls for six months, allowing oil companies to operate relatively freely in Venezuela, took many in the industry by surprise, setting off a rush to Caracas by would-be deal makers.

Venezuela has more than 40 oil partnerships with foreign and local companies, some of which suspended activity due to the difficult business climate. The government now seeks to replace these with companies willing to make new investments and produce.

The government is targeting production of 1 MMbpd, from about 750,000-800,000 bpd currently. The nation has about 300 Bbbl of reserves, a greater number than Saudi Arabia.

The country could reach that target by end of next year if the U.S. extends its license for another six months after it expires in March, according to Asdrúbal Oliveros, head of Caracas-based consultancy Ecoanalitica.

“The question is if this opening will last,” Oliveros said in a webcast this month.

Shell declined to comment. Repsol, Mol Nyrt, Maha Energy, the National Gas Company of Trinidad and Tobago and Bolivia’s state gas company YPFB didn’t reply to written requests for comment.

Venezuela’s information ministry, oil ministry and PDVSA didn’t reply emails seeking comment.

The Maduro government and a coalition of opposition parties signed an agreement in Barbados in October that contains guarantees for a fairer presidential election in 2024, including foreign observers and the release of political prisoners.