Russia is not just losing on the battlefield, it’s also getting its butt kicked in the energy marketplace. The United States is the primary champion, eating into Russian oil and natural gas sales — markets it won’t get back.

When President Putin invaded Ukraine, he thought it was the first step toward rebuilding the old Soviet Union. But the West coalesced around Ukraine, vowing to help it defeat Russia militarily and economically. Despite the discomfort, Europe has weaned itself from Russian oil and gas.

“Over the past year, the United States and Europe have thrown our energy security cooperation into even higher gear,” said U.S. Secretary of State Antony Blinken. “In 2022, the United States exported 56 billion cubic meters of liquefied natural gas to Europe. That is 40% of Europe’s total imports. It’s 140% increase over our LNG exports to Europe the previous year.”

Russia’s share of the European market has fallen from 40% to 10%. And there’s not enough pipeline capacity or LNG infrastructure to replace that — in those countries that may be willing to buy its discounted energy exports.

Meanwhile, Europe uses 19% less gas by decreasing demand and using energy-efficient technologies while also increasing its use of green energy. Luckily, it averted a harsh winter season. But in the future, it is storing more natural gas just in case the winters are frigid. It also added 23 LNG import terminals, allowing ships to carry the frozen fuel to it before liquefying and piping it to where it is needed.

To top it off, Europe bans Russian seaborne oil cargoes — a bonus for U.S. oil producers. According to the U.S. Energy Information Administration, U.S. companies sent about 10 million barrels a day in February, which compares to 7.6 million barrels a day a year earlier. Since 2018, this country has been a net exporter of energy.

Natural gas prices have moderated since the height of the war. In the United States, they are slightly more than $2 per million Btus, down from $6. In Europe, they are about $14, down from $40 — a number still high enough to encourage it to go green. The United States has seven LNG export terminals that could benefit Asia.

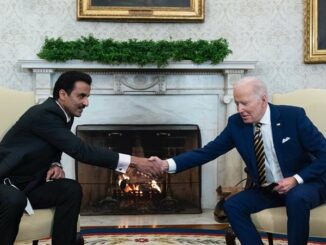

“We are one of the big three,” referring to the globe’s biggest LNG exporters: the United States, Qatar, and Australia, says Daniel Yergin, vice chair S&P Global, at a forum hosted by this reporter. “This innovation has contributed in so many different ways, including the balance of payments” — the difference in value between payments into and out of a country. “It saves us $400 billion a year. What a contribution to the U.S. economy and to energy security.”

Chenier Energy, Chesapeake EnergyCHK, ChevronCVX Corp., ExxonMobilXOM Corp., and Shell are among the major U.S. LNG producers.

Can China Save Russia?

Russia is looking for friends and markets where it can find them. The most conspicuous places are China and India. And while China’s President Xi just met with Russia’s Putin, it had more symbolism than substance. China spoke of an unfettered friendship between the two nations, although its economic ties extend to much of the world — places that are aghast at the tragedy now occurring in Ukraine. It’s financial wellbeing is thus tied to the global community, although it does like getting discounted oil and gas to feed its energy-starved economy.

About three-quarters of all Chinese imports are tied to oil. In fact, it doubled its Russian oil imports to $10 billion in October 2022. It only gets 6% of its natural gas from Russia, mainly because the gas pipeline infrastructure is limited. Under any circumstance, China is looking to get the best deal. Meanwhile, India has gone from importing almost nothing to 1 million barrels daily of Russian oil. Both countries aim to be carbon neutral — a healthy pursuit attracting foreign investment to their shores.

Russia had been the largest exporter of oil and gas. “China is the largest importer,” says Edward Chow, senior associate, Energy Security and Climate Change Program at the Center for Strategic and International Studies. “It is natural they would have a relationship. But the war makes it more complicated. Yes, Chinese imports have gone up — but at a big discount. China took advantage of this.”

Putin didn’t think the West had the stomach, will, or treasury to defend Ukraine. But under President Biden, the free world didn’t just stick together and defend freedom. It expedited its move to renewable energy. SolarPower Europe estimates rooftop solar power grew by 47% on the continent between 2021 and 2022. Altogether, Europe added 50 gigawatts of wind and solar in 2022, avoiding 11 billion cubic meters of natural gas, adds the International Energy Agency.

“The world is so tight for energy that everything is needed,” including LNG — best illustrated by Russian hostilities, says Tellurian’s Chief Executive Charif Souki, in an interview. “The reality is that 15% of the world uses 40% of the world’s energy. The other 85% aspire to the same living standards. The demand for energy on a global basis will outpace our ability to supply it.”

It’s a sad ending to Russia’s 30-year romance with the West, which gave it access to newfound energy markets and welcomed it into the international fold. Now Russia is sanctioned economically and cut off diplomatically, all because it seeks to destroy its peaceful, democratically-determined neighbor. To add salt to its wounds, the United States is the crucial benefactor, which has discovered new and lucrative LNG markets in Europe — a temporary boost, given Europe’s quest to go green and hit net-zero targets.