Shell has announced its fourth quarter 2020 results.

‘2020 was an extraordinary year. We have taken tough but decisive actions and demonstrated highly resilient operational delivery while caring for our people, customers and communities. We are coming out of 2020 with a stronger balance sheet, ready to accelerate our strategy and make the future of energy. We are committed to our progressive dividend policy and expect to grow our US dollar dividend per share by around 4% as of the first quarter 2021.’ Royal Dutch Shell Chief Executive Officer, Ben van Beurden.

STRONG OPERATIONAL DELIVERY IN AN EXTRAORDINARY YEAR

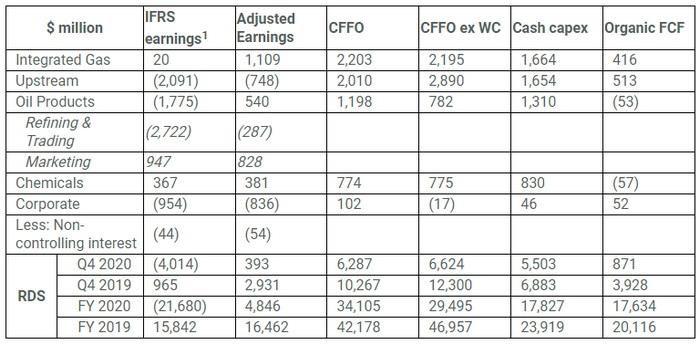

- Resilient financial results, with sector-leading cash generation. Net debt reduced by $4 billion to $75 billion during 2020.

- Exceeded cash preservation targets set in March 2020:

- Cash capex decisively reduced to $18 billion in 2020, from $24 billion in 2019, against a target of $20 billion or lower.

- Underlying opex of $33 billion in 2020, down by $4 billion, from $37 billion in 2019, against a reduction target of $3 to $4 billion.

- The Board expects that the first quarter 2021 interim dividend will be US$0.1735 per share, an increase of ~4% over the US dollar dividend for the fourth quarter 2020.

(1) Income/(loss) for Q4 2020. Oil Products, Chemicals and Non-controlling interest presented on a current cost of supplies basis.

Q4 2020 FINANCIAL PERFORMANCE DRIVERS

INTEGRATED GAS AND NEW ENERGIES

- LNG realised prices significantly below Q4 2019, with some recovery seen during the quarter.

- Average trading and optimisation results.

- Lower opex driven by lower operations and maintenance costs as well as underlying structural cost reductions.

- Strong cash conversion despite derivatives cash outflow.

OUTLOOK FOR Q1 2021

Production: 900 – 950 thousand boe/d

Liquefaction volumes: 8.0 – 8.6 million tonnes

UPSTREAM

- Lower prices, lower demand and unfavourable deferred tax movements driving lower Adjusted Earnings.

- Production 14% lower compared with Q4 2019 due to OPEC+ curtailments, divestments, higher maintenance, lower gas demand and hurricanes in US Gulf of Mexico.

- Lower opex driven by revisions to D&R provisions, divestments as well as underlying structural cost reductions.

- Strong cash conversion with CFFO excluding working capital contribution of $2.9 billion.

OUTLOOK FOR Q1 2021

Production: 2,400 – 2,600 thousand boe/d

OIL PRODUCTS

- Continued weakness in refining margins, despite some recovery from Q3 2020, lower intake and utilisation due to lower demand and Convent refinery shutdown.

- Strong Marketing unit margins offset by lower volumes due to COVID-19 second wave.

- Lower opex driven by lower maintenance costs and Marketing spend as well as underlying structural cost reductions.

- Trading and optimisation results significantly below average.

OUTLOOK FOR Q1 2021

Sales volumes: 4,000 – 5,000 thousand b/d

Refinery utilisation: 73% – 81%

CHEMICALS

- Higher base and intermediate chemicals margins across most product segments.

- Higher JV income due to improved margins and demand in Asia.

- Strong cash conversion with CFFO excluding working capital contribution of $0.8 billion.

OUTLOOK FOR Q1 2021

Sales volumes: 3,600 – 3,900 thousand tonnes

Manufacturing plant utilisation: 80% – 88%

CORPORATE

- Net debt increased by $1.9 billion to $75.4 billion in Q4 2020. Impacted by lower free cash flow, including a small working capital outflow.

OUTLOOK FOR 2021

Adjusted Earnings: net expense of $2,400 – $2,800 million for the full year 2021. This excludes the impact of currency exchange rate effects.

Q4 2020 PORTFOLIO DEVELOPMENTS

- During the quarter, QGC Common Facilities Company Pty Ltd, a wholly-owned subsidiary of Shell, announced that it has agreed to the sale of a 26.25% interest in the Queensland Curtis LNG Common Facilities to Global Infrastructure Partners Australia for US$2.5 billion. The transaction is subject to regulatory approval in Australia and customary conditions and is expected to complete in the first half of 2021.

- In January 2021, Shell completed the sale of its 30% interest in Oil Mining Lease 17 in the Eastern Niger Delta, and associated infrastructure, to TNOG Oil and Gas Limited, a related company of Heirs Holdings Limited and Transnational Corporation of Nigeria Plc, for a consideration of $533 million. A total of $453 million was paid by completion with the balance to be paid over an agreed period.

Click here for full announcement

Source: Shell