Forecast overview

- U.S. economy. Our forecast assumes U.S. GDP growth of 1.5% in 2023 and 1.3% in 2024, which is revised up from last month’s forecast of 1.3% in 2023 and 1.0% in 2024. The upward revision is partially driven by an updated estimate of real GDP growth in the first quarter of 2023 (1Q23) resulting from more consumer spending and aggregate investment than assumed in last month’s STEO. We use the S&P Global macroeconomic model, and we input our energy price forecasts to get the forecasts for the U.S. economy used in STEO.

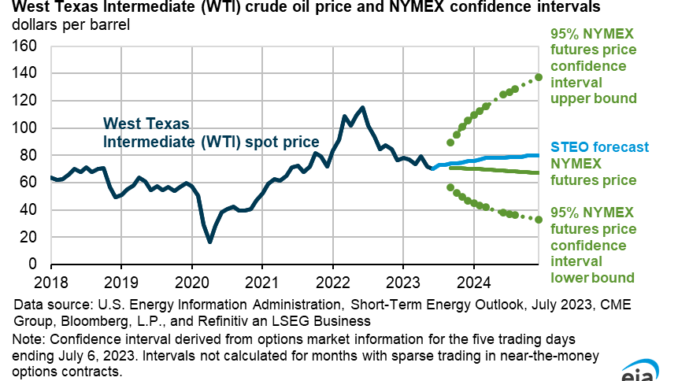

- Crude oil prices. We forecast that the Brent crude oil spot price will average $78 per barrel (b) in July. Crude oil prices gradually increase throughout our forecast, reaching about $80/b in 4Q23 and averaging about $84/b in 2024 because we expect that global oil inventories will decline over the next five quarters.

- U.S. renewable diesel production. As a result of the U.S. Environmental Protection Agency’s (EPA) revised Renewable Fuel Standard (RFS) rule establishing biofuel volume requirements that was issued on June 21, we have reduced our forecast for renewable diesel production growth. However, we still expect renewable diesel production will grow in the United States to reach 219,000 b/d in 2024.

- Natural gas prices. We expect the Henry Hub spot price will rise in the coming months as declining natural gas production narrows the existing surplus of natural gas inventories compared with the five-year average. Henry Hub prices in our forecast average more than $2.80 per million British thermal units (MMBtu) in the second half of 2023 (2H23), up from about $2.40/MMBtu in the first half of the year.

- Electricity generation. Solar has been the leading source of new generating capacity in the United States so far this year, and the new capacity contributes to our forecast of 23% more U.S. solar generation this summer (June, July, and August) than last summer. The increase in solar capacity, along with lower natural gas prices, reduces our forecast of coal-fired electricity generation this year. We expect that U.S. coal-fired generation during 2H23 will be 75 billion kilowatthours (18%) less than 2H22.

- Supplements. We periodically publish report and article supplements to the STEO to provide an in-depth analysis of special topics related to our forecasts. This month’s Between the Lines article discusses our U.S. LNG exports forecast.

| Notable Forecast Changes | 2023 | 2024 |

|---|---|---|

| The current STEO forecast was released July 11. The previous STEO forecast was released June 6. |

||

| U.S natural gas consumption in the electric power sector (current forecast) (billion cubic feet per day) | 34.5 | 33.5 |

| Previous forecast | 34.3 | 32.5 |

| Percentage change | 0.7% | 3.2% |

| U.S. LNG exports (current forecast) (billion cubic feet per day) | 12.0 | 13.3 |

| Previous forecast | 12.1 | 12.7 |

| Percentage change | -0.2% | 4.6% |

| U.S. renewable diesel production (current forecast) (million barrels per day) | 0.161 | 0.219 |

| Previous forecast | 0.157 | 0.225 |

| Percentage change | 2.2% | -2.8% |

| U.S. electric power sector generation from coal (current forecast) (billion kilowatthours) | 629.1 | 610.5 |

| Previous forecast | 641.5 | 650.5 |

| Percentage change | -1.9% | -6.1% |

| U.S. coal production (current forecast) (million short tons) | 572.2 | 460.3 |

| Previous forecast | 559.5 | 478.4 |

| Percentage change | 2.3% | -3.8% |

You can find more information in the detailed table of forecast changes.