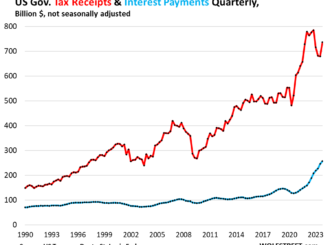

Curse of Easy Money: US Government Interest Payments on the Ballooning Debt v. Tax Receipts, Higher Interest Rates, Inflation

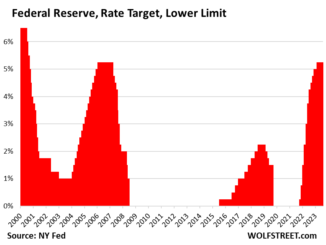

Biggest Drunken Sailors of all. Average interest rate on the Treasury debt spiked but is still only half of what it was in 2001. By Wolf Richter for WOLF STREET. Interest payments as a percent of tax receipts is […]