Condos in Toronto hit 28-month low. But Vancouver house prices only -3.9% from peak in 2022. Calgary house prices jump to new high; oil boom helps.

By Wolf Richter for WOLF STREET.

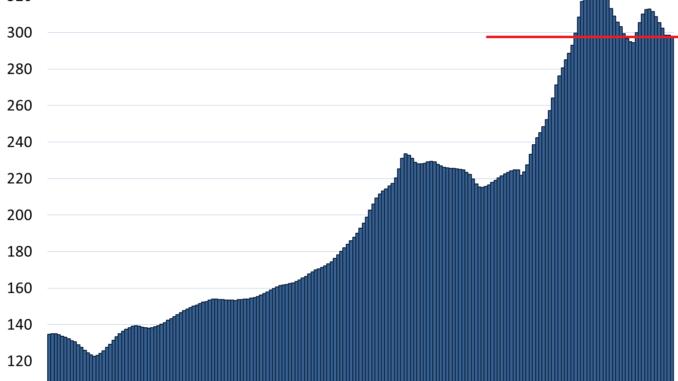

Condo prices in Canada fell 0.7% in March from February, seasonally adjusted, while house prices edged up 0.3%, and so the Composite MLS Home Price Index edged down 0.1%, according to data from the Canadian Real Estate Association (CREA) today.

The index has now fallen 14.1% from two years ago, from the peak in March 2022, and is back where it had first been in September 2021.

Year-over-year, the index was up 1.2%, same as in February. But there was a wide divergence between the major markets, and between houses and condos in some markets. And we’ll get to them.

Home sales inched up 0.5% in March from February but remain about 10% below the 10-year average. From the beaten-down levels in March last year, sales rose 1.7%.

In terms of supply coming on the market for the spring, it appears to be happening: “Weekly tracking showed a bounce in new supply around the second week of March, which led to a burst of sales in the last week of the month, and a jump in listings in the first week of April,” CREA said.

“Will the story be high interest rates keeping a lot of people on the sidelines this year, or the much expected and anticipated first rate cuts enticing a lot of people back into the market? Probably a bit of both,” CREA said.

The Bank of Canada has tightened policy to deal with inflation, hiking its overnight rate to 5.0% in July and keeping it there. Under its QT program, the BOC has also shed 64% of its pandemic QE assets. Canada’s economy is slowing, home prices have fallen off their peak in 2022, inflation has cooled, except for rents, where inflation rages with historic fervor, with rents spiking 10% fueled by a 3.2% surge in the population due to an explosion of immigration. It’s the rental market that feels the onslaught of immigration, not the purchase market.

Home Prices by major Housing-Bubble Market.

Greater Toronto Area, single-family houses: The MLS Home Price Benchmark Index for single-family houses (all prices in Canadian dollars):

Month-to-month: +1.3% to $1,319,000; below October 2021

From peak in February 2022: -15.3%, or -$237,800

Year-over-year: +2.7%.

Greater Toronto Area, Condos:

Month-to-month: -0.5% to $678,400, back to October 2021

From peak in February 2022: -13.2%

Year-over-year: -1.1%

Hamilton-Burlington metro single family houses (in the “Greater Toronto and Hamilton Area”): Single-family benchmark price:

Month-to-month: +1.7% to $897,600, back to June 2021

From peak in February 2022: -20.6% or -$232,700

Year-over-year: +2.8%

Hamilton-Burlington metro condos:

Month-to-month: -0.8%, to $529,700, back to October 2021

From peak in April 2022: -16.5%

Year-over-year: -0.8%

Greater Vancouver single-family houses:

Month-to-month: +0.3% to $1,986,700 (essentially flat for three months)

From peak in April 2022: -3.9% or -$70,700

Year-over-year: +7.7%

Greater Vancouver condos:

Month-to-month: -0.6%% to $767,100

Year-over-year: +5.6%

Victoria, single-family houses:

Month-to-month: unchanged, at $1,125,300, back to October 2021

From peak in April 2022: -11.2% or -$142,000

Year-over-year: +2.2%

Ottawa, single family houses:

Month-to-month: essentially unchanged at $709,200, back to May 2021

From peak in March 2022: -11.4% or -$91,500

Year-over-year: +3.3%.

Calgary, single family houses, oil boom helps:

Month-to-month: +1.3% to new high of $667,700

Year-over-year: +13.4%.

Montreal, single family houses:

Month-to-month: +1.4%, to $613,400, below January 2022

From peak in May 2022: -3.6%

Year-over-year: +4.7%.

Halifax-Dartmouth, single family houses:

Month-to-month: -2.1% to $526,700

From peak in April 2022: -6.2%

Year-over-year: +5.3%.

Quebec City Area, single-family houses:

Month-to-month: -0.4% to $393,600

Year-over-year: +6.9%

High was in December 2023.