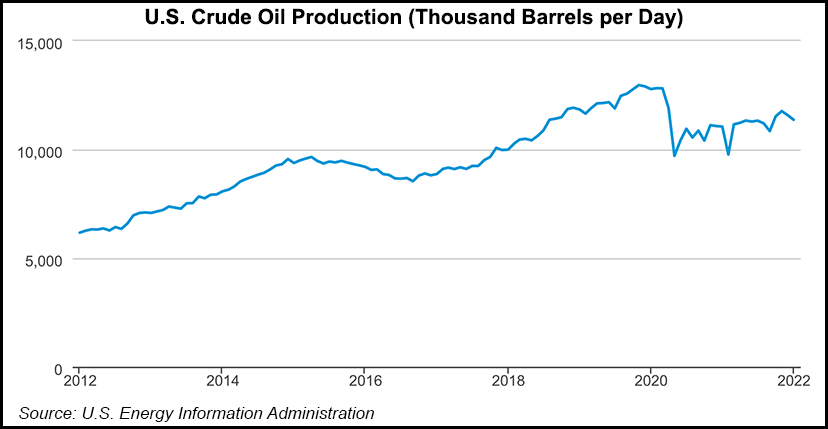

Domestic crude oil production edged upward last week, the U.S. Energy Information Administration (EIA) reported Wednesday.

For the week ending April 1, U.S. crude oil production increased by 100,000 b/d to 11.8 million b/d, according to EIA’s latest Weekly Petroleum Status Report

It was yet another weekly uptick in domestic oil output after spending February and part of March in 11.6 million b/d territory.

EIA data showed a 2.4 million bbl week/week build in U.S. commercial crude oil inventories, which finished last week at 412.4 million bbl. Domestic crude stocks ended last week about 14% below the five-year average for this time of year.

Demand was 19.8 million b/d for the week ending April 1, staying essentially flat week/week and year/year.

During the past four weeks, demand averaged 20.4 million b/d, up 5.5% year/year. Motor gasoline consumption for the past four weeks averaged 8.7 million b/d, down 0.3% from the corresponding period in 2021. Meanwhile, distillate fuel demand averaged 3.9 million b/d for the four-week span, representing a 1.8% year/year increase. Jet fuel product supplied was 1.5 million b/d for the period, up 28.9% year/year.

The West Texas Intermediate (WTI) oil price was $99.32/bbl on April 1, or $16.88 below the previous week’s price and $32.88 more than a year ago, EIA said.

EIA also reported a national average retail regular gasoline price of $4.17 per gallon, down six cents from a week ago but up $1.31 year/year. The national average retail diesel price declined 41 cents week/week to $5.14 per gallon, which is still $2 higher than it was at this time in 2021.

The Biden administration recently launched a 1 million b/d drawdown of crude from the U.S. Strategic Petroleum Reserve (SPR) over 180 days in an effort to boost U.S. oil supplies and reduce fuel prices at the pump.

SPR inventories decreased by 535,000 b/d last week, representing a 25% larger drawdown from 429,000 b/d the previous week.

Rystad Energy said the SPR release has already contributed to a decline in oil prices, but the consultancy added that it expects relative relief for consumers to be temporary.

Rystad’s Claudio Galimberti, senior vice president for analysis, said the 1 million b/d average SPR release would counter a potential drop in Russian crude exports of more than 2 million b/d.

“This historically large SPR release is the right decision in the current crisis and consumers should feel the benefit soon, but it only solves half the problem,” he said.

Mizuho Securities USA LLC’s Bob Yawger, director of energy futures, said the 11.8 million b/d figure matches a “Covid era high.”

He added, however, that the “all-time record production number is 13.1 million in March 2020.”

Yawger said the crude oil price “violated the 50 day moving average on Friday for the first time since January 4 but has not been able to leave the measure in the rear view mirror.”