As I sit down on this July 4th holiday weekend, it is a time to reflect on what a great country we live in. We take things for granted like the freedom to travel, and the ability to follow our dreams. While the economic turmoil we are facing due to inflation and the energy crisis is causing some disruptions, we still have millions of people around the world trying to get to America and call it home.

As we reflect on the great things that have happened in our country, I took some time to look at some of the social and economic patterns. Data and charts don’t lie, and they are an excellent resource for analyzation of historical market performance.

One key factor when looking at past recessions and market performance is that none of them had the broken supply chain and energy crisis exacerbating the markets. As the world became a more integrated supply chain running on a just-in-time inventory system, when it broke it really broke. The energy crisis also was integrated through world trade and economic interdependence. These two critical markets influencing the crisis have set up this almost certain recession to question the applicability of historical data and charts.

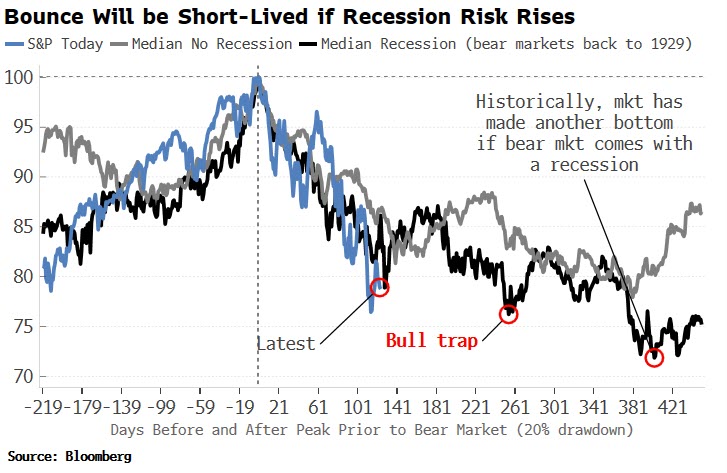

Bloomberg published an article last week that had some great points on the looming recession and potential Bull Trap.

“Coming off the worst first-half since 1970, US equities now face a triple whammy of sticky inflation, recession risks, and the threat to corporate profits from sinking consumer confidence. After just about everyone on Wall Street got their 2022 predictions wrong, investors are now focused on a toxic mix that spells stagflation, as well as more damage to valuations.”

“The next 10% will probably be down from here, not up,” said Scott Ladner, chief investment officer at Horizon Investments. “A quick market bottom will need a turn in central bank policy, and we don’t think that’s a possibility in the next few months.”

Indeed, the Federal Reserve is expected to go on hiking rates as it tries to tame inflation, rather than flush the market with cash like it did in 2008 and 2020 — pretty much the rocket fuel for the powerful bull market that’s now come to a halt.

This year is already one of the worst in terms of big daily declines, with the S&P 500 Index falling 2% or more on 14 occasions, putting 2022 in the top 10 list according to data compiled by Bloomberg going back two decades.”

As I have talked about in previous articles, we are in the 4th commodities boom in the history of the world. Commodities booms are the single biggest points in time when the rich get richer, and the poor get poorer. In this boom, the energy markets are displaying incredible resilience and are some of the few areas for investors that can provide a haven for investors facing higher taxes and inflation.

Some of the key issues that are being discussed in the political arena is the Windfall Profit Tax being called for by many politicians. These windfall taxes will only make the problem worse by reducing the available capital to invest in drilling programs, and thus continuing to drive the price up. When coupled with the commitment displayed by the CEOs of the Big Oil companies to deliver returns to investors, you can see that there is only room for the price to go up.

The Bottom Line

At what point will demand destruction kick in, and will it be enough to lower the price of oil? In my opinion, no. JPMorgan analysts warned that the call from the Biden administration to inflict “retaliatory crude-output cuts” will potentially drive the price to $380 oil. Just like sanctions, this retaliatory action will not only have a negative impact but will also drive prices up even further.

So, the Biden administration has already taken some actions to try and solve the “pain at the pump”. Releasing oil from the SPR, begging Saudi Arabia for oil, and enforcing the declared war on the U.S. oil and gas market are all examples of the total failure of the administration’s ability to enact policies that can reduce the energy crisis impact on the potential looming recession.

If the windfall tax policies are imposed on the oil and gas companies, the investors will be impacted, but look to still have returns that are better than almost any other sector. The consumers will be hurt even harder.

Will we see $380 oil? I do not think we will get that high, but the mix of demand destruction, windfall tax policies, and the Biden administration war on oil and gas all add up to higher prices for oil and gas. To what extent, the sweet spot still appears to be the $115 to $125 range with spikes to $180 due to world geopolitical activities.

I for one am grateful to be an American on this 4th of July and will continue to do my part in delivering low-cost energy to the American markets. Have a safe and happy 4th of July!

As always, check with your CPA if alternative investments are good for your portfolio

Take the assessment and see if it is right for you HERE.

Please reach out to our team at any time for answers to your questions. Jay R. Young, CEO, King Operating

ForbesBooks Author of “The Upside of Investing in Oil and Gas”