Welcome to Grid Brief! Normally, today would be our rundown of power generation in America’s power markets. But the Energy Information Administration is still ironing out its data maintenance. So, rather than looking at generation, we’re going to look at reliability and resource adequacy in America’s power markets based on two recent reports: the North American Electric Reliability Corp.’s Winter Reliability Assessment and the National Association of Regulatory Utility Commissioners Resource Adequacy Report.

What’s Keeping the Lights On?

As ever, here’s a map to orient you as we move through each power market.

And here’s a map of winter reliability risk levels from the NERC report:

“A large portion of the North American Bulk Power System (BPS) is at risk of insufficient electricity supplies during peak winter conditions. Prolonged, wide-area cold snaps threaten the reliable performance of BPS generation and the availability of fuel supplies for natural-gas-fired generation,” reports NERC. “As observed in recent winter reliability events, over 20% of generating capacity has been forced off-line when freezing temperatures extend over parts of North America that are not typically exposed to such conditions.”

ISO-New England

According to NARUC’s Resource Adequacy report, ISO-NE is facing several challenges to maintaining adequacy: greater renewable energy penetration on the grid, rising power demand, seasons limits to natural gas deliverability, and retiring power plants.

NERC’s report on New England reflects NARUC’s assessment: during very cold weather, when both electricity and heating needs are at their highest, the pipelines that transport natural gas might struggle to handle the high demand. This could cause problems in delivery problems, which might strangle power gas plant supplies and trigger energy shortages during extreme weather.

According to reporting from Utility Dive, ISO-NE recently delayed its 2025 forward capacity auction (its main tool for tackling resource adequacy) in order to finish a study of its natural gas system to “accurately value the reliability contributions of all resources.”

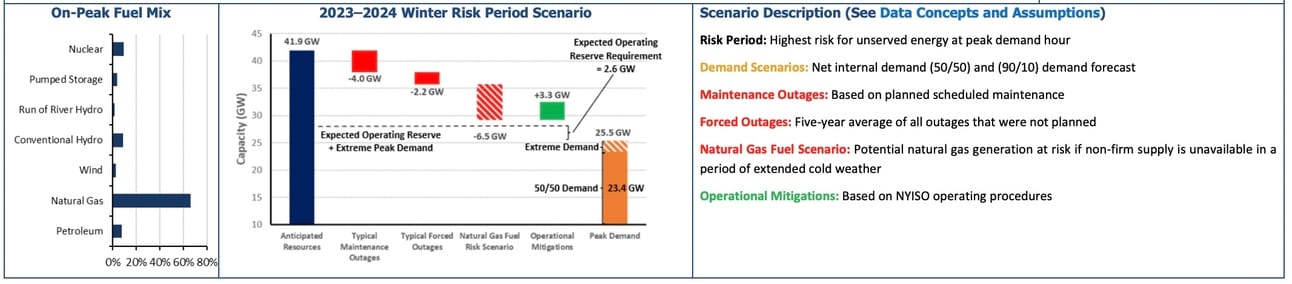

New York ISO

NARUC lays out two major challenges to resource adequacy in New York state: more renewables are coming online and reserve margins are shrinking. “Generators needed for reliability are planning to retire. Delays in the construction of new generating resources and transmission, higher than expected demand, and extreme weather could threaten reliability and resilience in the future,” reports NARUC.

Regardless, NERC does not believe the Empire state is under any threat of power supply shortages this winter.

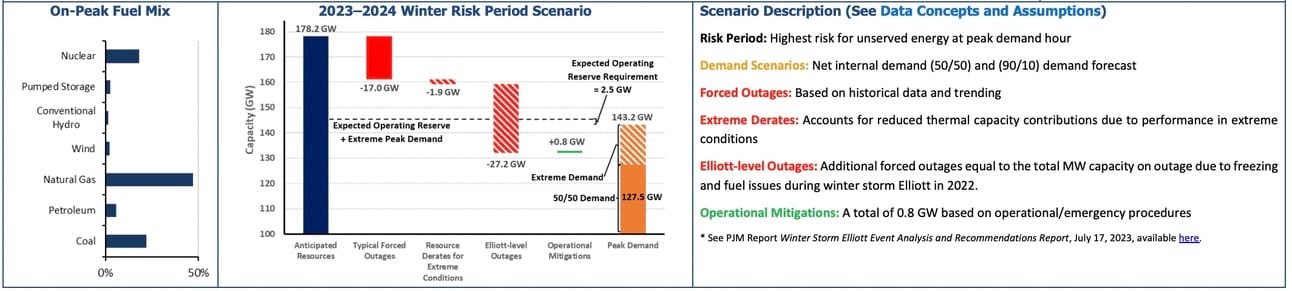

PJM

NARUC reiterated the reliability issues PJM, America’s largest power market, identified in a report the grid operator published earlier this year. Like other power markets, PJM faces a rising ride of retirements and intermittent power sources.

As for PJM’s reliability this winter, NERC says that a severe cold weather event that spans the Mid- and Southeast could trigger energy emergences as operators juggle simultaneous spikes in demand and outages. Peak demand forecasts have risen in PJM since Winter Storm Elliott while resources has remained the same. PJM has enough resources for “normal winter conditions,” writes NERC, but “their generators are vulnerable to derates and outages in extreme conditions.”

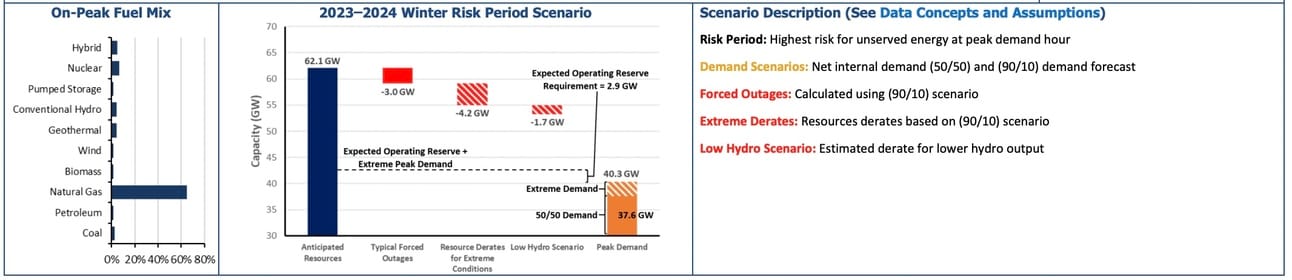

MISO

NARUC indicates that MISO grapples mightily with resource adequacy at present. It has faced greater risk of insufficient capacity in all seasons. “General trends recently have included additional retirements of dispatchable fossil fuel resources in MISO and growing reliance on renewable generation, energy market imports, and emergency-only demand response,” reports NARUC.

“New wind and natural-gas-fired generation and the extension of some older fossil-fired plants have increased available resources this winter by over 9 GW from 2022. Recently, MISO implemented a seasonal resource adequacy construct that more effectively values risks and resource contributions that vary by time of year,” reports NERC. “Like prior years, an extreme cold-weather event that extends into MISO’s southern areas can cause high generator outages from inadequate weatherization or insufficient natural gas fuel supplies.”

ERCOT

NARUC reports that ERCOT faces resource adequacy challenges similar to the other regions, but NARUC has identified two other issues: transmission line congestion as the uptick in electric vehicles as additional challenges.

“Like other assessment areas in the Southern United States, the risk of a significant number of generator forced outages in extreme and prolonged cold temperatures continues to threaten reliability where generators and fuel supply infrastructure are not designed or retrofitted for such conditions,” reports NERC. This problem is exacerbated by increasing demand and stagnant capacity additions in the state.

SPP

To handle resource adequacy, Southwest Power Pool is retooling it “resource adequacy requirements” and adjusting its capacity accreditations for solar and storage.

“The Anticipated Reserve Margin (ARM) of 38.8% is over 30 percentage points lower than last winter; this is driven by higher forecasted peak demand and less resource capacity,” reports NERC. And while this is enough for normal demand peaks and generator outages, but extreme cold could still spawn shortfalls.

Not to mention, SPP is wind-heavy. “You can see from our analysis that whether or not there’s going to be reliability risks in certain areas really depends on whether or not the wind output is as strong as we forecast it to be,” NERC’s director of reliability assessment and performance analysis Dave Moura said. “I was surprised by how much it depends on things that the electricity industry simply can’t control.”

CAISO

Of the suite of tools available to California’s grid operator, CAISO is leaning into demand response as a way to navigate resource adequacy issues.

NERC isn’t worried about California this winter.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack