Energy News Beat Publishers Note: DRW has the #Technical Tuesday right on the money. There are some great nuggets in this article.

“The magnitude of shareholder value destruction at Ovintiv demands a sense of urgency we have yet to witness from the Board and management team. Kimmeridge is prepared to help drive the change the company desperately needs by nominating directors to the Ovintiv Board at the upcoming annual meeting.”

– Mark Viviano, Managing Partner and Head of Public Equities at Kimmeridge

As we know with the #hottakeoftheday, anyone can start a website and send a letter to management, but Kimmeridge does it better than most. Last week, they published their website, fixovintiv.com, and I have to say, they have style. Presentations are much better than letters, and, similar to the Little Engine that could and their letter to Exxon, these investors aren’t wrong. Our industry has been plagued by poor governance and poor capital allocation. We have grown production when we should have been paying off debt, we have waited too long to consolidate, and we have changed management control packages the day before a major deal was announced, and in spite of that, get asked to join the board of another major E&P company, as a random, non specific example. I do object though when Kimmeridge (and others) throw around “environmental stewardship”. Hedge funds, active though they may be, aren’t known for their environmental stewardship as much as they are known for “we will use buzz words that play well, and yes, our grandmothers are for sale for $1, DM me if interested.” Our industry, though not perfect, has a tremendous record of safety and we continue to take steps to mitigate the environmental impact. Are we perfect? No. Should we aggressively address flaring and venting of methane? Absolutely. But from minimizing our environmental footprint through multi well pads to community engagement and significant charitable giving, we are pretty good.

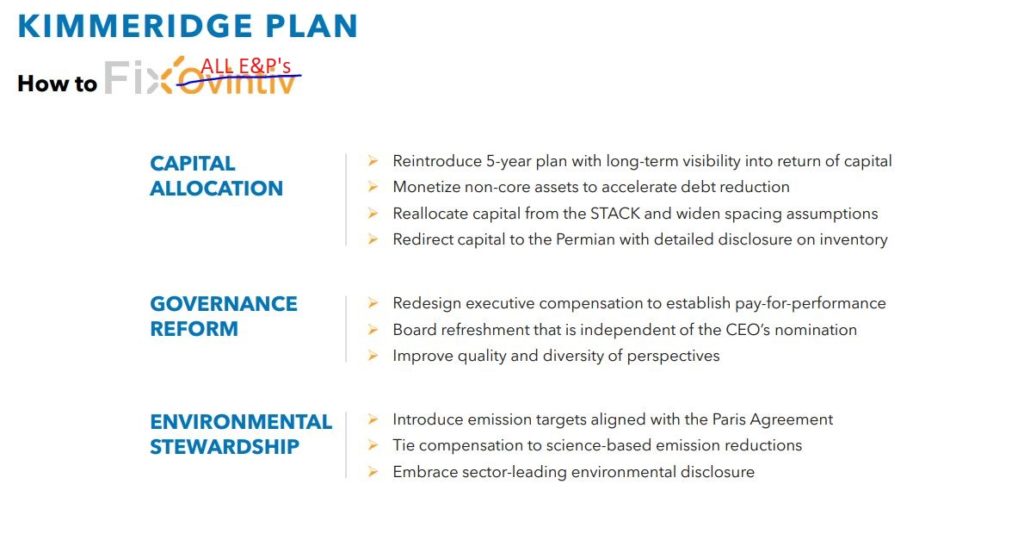

What are the main thrusts of the objections to Ovintiv? Let’s go to slide 3, shall we (I told you, they make great presentations!).

OK. I think we can all agree that September 2014 wasn’t exactly the time to be entering into huge merger agreements (ask Four Point) but Ovintiv (Encana) wasn’t alone. When the Saudi’s stopped supporting the oil price and oil crashed from over $100/bbl to under $30/bbl, the fundamental basis of the shale revolution that had started en masse in 2008, coupled with the Great Recession, changed. Inventory that worked at $100 still doesn’t work today. Companies weren’t hedged, they weren’t raising enough equity, and they were relying on supercharging their balance sheet with debt (as the Fed, State and Local governments and many others are doing right now). Their Newfield acquisition was closed in February 2019 (announced at the end of 2018) was arguably far more impactful to the negative underperformance vs. their multi basin STACK/SCOOP peers and, as we’ve seen in rig counts, completion counts and overall activity, Oklahoma has lagged the Permian.

As with anything in oil and gas, timing is everything. If you had gone into a coma from January 19 – 2020 until today, you would find that oil is about the same level, many stocks are about the same level, the S&P is up roughly 10% from last year, and you would look at the free cash flow targets and goals from Ovintiv that were announced 3 weeks ago as pretty reasonable. Debt was reduced by $257 mm in Q4, they expect to reinvest 70% of this years cash flow at $45/bbl and $3/mcf in the capital program with all excess cash flow going to debt repayment, and they have hedges in place to additionally protect downside.

The proof will be in the pudding whether Ovintiv (and ALL E&Ps) can learn from the pain of 2020 and run our businesses better, with less debt, more hedging, more long term planning, more focus on spacing and recognize that we are a commodity business and that therefore, timing is everything. So I’ll use slide 15 from Kimmeridge and say: I hope every E&P is reading this, because you don’t need to be an activist to know that these are all the right things to do.

NOTE: When Ovintiv files it’s YE2020 report, we will supplement this post with fresh data and have a look at the value proposition.

Energy News Beat Publishers Note: Sign up for all of #hottakeoftheday and DRW at https://hottakeoftheday.com/subscribe/