In an era where headlines are dominated by stock market volatility, housing bubbles, and geopolitical tensions, a quieter but potentially devastating economic threat is brewing: electricity inflation. Over the past five years, electricity prices have surged by 35%, far outpacing the modest 12% increase seen in the decade prior.

This isn’t just a blip on the radar—it’s a structural shift driven by soaring demand, policy missteps, and supply constraints that could ripple through households, businesses, and entire economies. As we electrify everything from vehicles to data centers, the cost of keeping the lights on is poised to become the next major financial crisis, squeezing budgets and fueling broader inflationary pressures.

The Broader Picture: Why Electricity Prices Are Skyrocketing

Electricity inflation isn’t getting the attention it deserves, especially when compared to more visible culprits like gasoline prices. Yet, it’s rising at nearly double-digit annual rates, often underreported in standard Consumer Price Index (CPI) calculations that dilute its impact on monthly bills.

Several factors are converging to drive this trend:

Demand Overload from Electrification and Tech Boom: The push towards electric vehicles (EVs) and renewable energy integration is straining grids worldwide. But the real game-changer is the explosion in artificial intelligence (AI) and data centers, which are gobbling up unprecedented amounts of power. Countries like China and Saudi Arabia are ramping up nuclear and solar capacities to meet this demand, signaling a global race for reliable energy.

Supply Chain and Policy Challenges: Premature retirements of traditional power plants, coupled with slow transitions to renewables, are creating gaps in supply. Investments in new generation are lagging behind demand, leading to volatility and higher costs passed on to consumers.

If unchecked, these dynamics could undermine the economics of high-growth sectors like AI, pose national security risks as energy dependencies shift, and exacerbate inequality by hitting low-income households hardest. Investors are starting to take note, viewing power generation as a ripe opportunity—but for the average consumer, it’s a looming crisis.

Nuclear is too far off in the United States to impact in the short term

Zerohedge writes:

- Energy = Electricity. We have started trying to disassociate energy with oil and make sure we highlight that energy, in this day and age, means electricity even more than oil and it is important for investors, corporations and politicians to think that way.

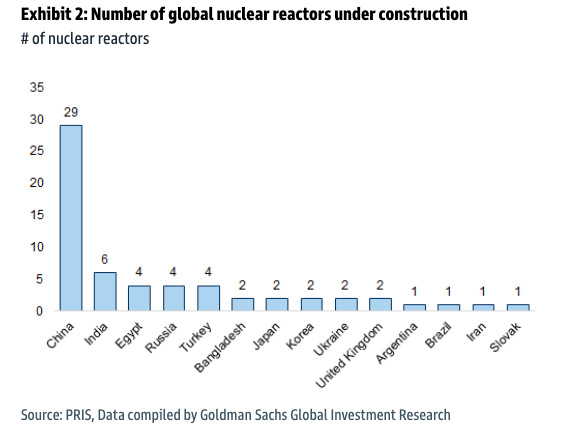

- It makes some of the charts about nuclear projects in development really raise your eyebrow (China is pushing hard in this direction).

- It also fits in with our theme that the Middle East, and Saudi Arabia in particular are pushing to become the data center capitals of the world. Oil is far more expensive to move than “data” and with a wealth of potential solar energy, they are positioned to meet the rising energy demands of AI and data centers. Also, buying a lot of high powered chips from American chip companies is a quick way to reduce trade surpluses.

- It makes some of the charts about nuclear projects in development really raise your eyebrow (China is pushing hard in this direction).

For the United States, we are making changes quickly, and the DOE is looking to have a few reactors come online in the next few years, but years are too late for consumer electricity inflation on their monthly bills.

Case Study: New Jersey’s Soaring Bills Despite Abundant Resources

New Jersey offers a stark example of how policy and infrastructure issues can amplify electricity inflation, even in a state blessed with reliable energy sources. With natural gas accounting for nearly 50% of its electricity generation and nuclear power contributing another 45%, one might expect stable, affordable rates.

Instead, residents are facing bills that have tripled in some cases, jumping from $300 to over $1,000 monthly without changes in usage.

As of May 2025, New Jersey’s residential electricity rate stands at 20.49 cents per kilowatt-hour (kWh), ranking 11th highest nationally and well above the national average increase of 6.5% year-over-year.

Why the disconnect? It’s not primarily generation costs—nuclear and natural gas provide cost-effective baseload power. The culprits appear to be:Policy Failures and Premature Plant Closures: Aggressive decarbonization goals, including a push for 50% renewables by 2030 and 100% carbon-neutral by 2050, have led to hasty decisions like the 2018 shutdown of the Oyster Creek nuclear plant.

Without adequate replacements, this has a strained supply, especially as renewables currently make up only about 4% of the mix (mostly solar at 2.9%).

Generator retirements are accelerating, as warned by PJM Interconnection, the regional grid operator.

High Distribution and Regulatory Costs: In a densely populated, Democratic-run state, taxes, subsidies for renewables, and infrastructure maintenance are inflating bills. Distribution networks, which transport power from plants to homes, are a major bottleneck. Aging grids require upgrades to handle fluctuating renewables and rising demand, but these costs are often passed directly to consumers through higher rates.

Compared to states like Hawaii (41.03 cents/kWh) or California (35.03 cents/kWh), New Jersey’s issues stem more from policy than geography, highlighting how regulatory hurdles can turn abundant resources into expensive liabilities.

Nationally, New Jersey’s woes mirror broader trends but are exacerbated by local factors, serving as a cautionary tale for other states pursuing rapid energy transitions without robust planning.

The AI and Data Center Factor: A Demand Tsunami

No discussion of electricity inflation is complete without addressing the elephant in the room: AI and data centers. These tech behemoths are driving a “structural demand” for energy, particularly natural gas, which powers much of the U.S. grid.

As AI models grow more complex, data centers’ power consumption is skyrocketing, with some facilities rivaling the energy use of small cities.

Impact on Natural Gas and Pricing: The rapid expansion of U.S. LNG export facilities is tied to this demand, but markets may be underestimating how quickly these will ramp up.

Projects like Plaquemines Phase 2 (already producing LNG as of July 2025) and Golden Pass Train 1 (taking feed gas ahead of schedule) signal faster-than-expected growth, potentially leading to shortages and price spikes.

This volatility feeds into electricity costs, as natural gas prices directly influence power generation expenses.

Broader Economic Ripples: Higher gas prices are already baked into stocks of mid- to large-cap producers, which have outperformed recently.

But if demand surges beyond supply—fueled by AI, EVs, and electrification—the result could be widespread inflation. Data centers are turning to nuclear for stable power, but scaling that up takes time, leaving natural gas as the bridge fuel with volatile pricing.

In New Jersey and beyond, this tech-driven demand compounds existing pressures, pushing grids to their limits and inflating bills further.

The Bottom Line: Averting the Crisis Before It Hits

Electricity inflation isn’t just an energy story—it’s an economic one with the potential to trigger the next financial crisis. From New Jersey’s policy pitfalls to the global AI energy hunger, the signs are clear: without balanced investments in supply, smarter regulations, and diversified energy mixes, costs will continue to climb. Policymakers must prioritize grid resilience and affordable transitions, while consumers and investors brace for higher bills. The time to act is now, before this silent surge becomes a full-blown storm.

Energy policies and the people you elect actually matter. It is a real concern, as we are seeing Net Zero and Green Energy policies globally devastate economies. This is not a fashion statement; it is a fact about fiscal collapse.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack