The price of yellow cake – uranium concentrate used in nuclear generation – has hit the highest level in more than 15 years, driven by soaring demand as a crucial energy source for a “green future.” Additionally, global supply disruptions are further pressuring prices higher.

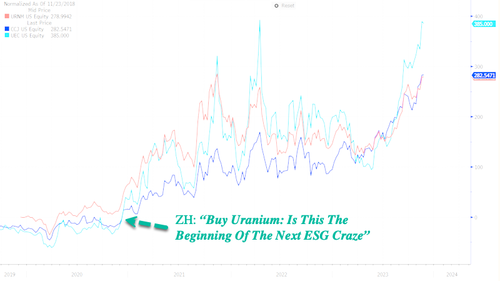

Nymex futures tracking physical-market contracts of uranium ore topped $80.25 per pound on Monday, the highest level since February 2008. Since we first recommended uranium stocks in December 2020, in a note titled “Buy Uranium: Is This The Beginning Of The Next ESG Craze,” uranium ore prices have soared 173%.

Prices have also exceeded the level last seen since the disaster at Japan’s Fukushima reactor put nuclear energy on worldwide probation — and in Germany, delivered it a death sentence — various factors, including decarbonization of power grids, have revived the nuclear industry.

While the International Energy Agency says to fulfill “net zero” goals – global nuclear generation capacity must double from 2020 levels by 2050 – demand for yellowcake is skyrocketing at a time when Western governments are sanctioning Russia, which currently accounts for about 8% of the world’s uranium supplies. This means the West must develop new supply sources.

According to Colin Hamilton, managing director for commodities research at BMO Capital Markets, “Utility contracting continues to pick up,” and “there is very little uncommitted production available to meet uncovered utility requirements.”

Bloomberg pointed out top miner Cameco Corp. has revised production targets lower due to various supply chain challenges in Canada, while a coup in Niger has disrupted shipments to Europe.

As for uranium stocks, Terra Capital’s Matthew Langsford told Bloomberg, “[Uranium] equities could see dramatic upside — 50%, 100%, possibly more.”

Uranium is back.

Loading…