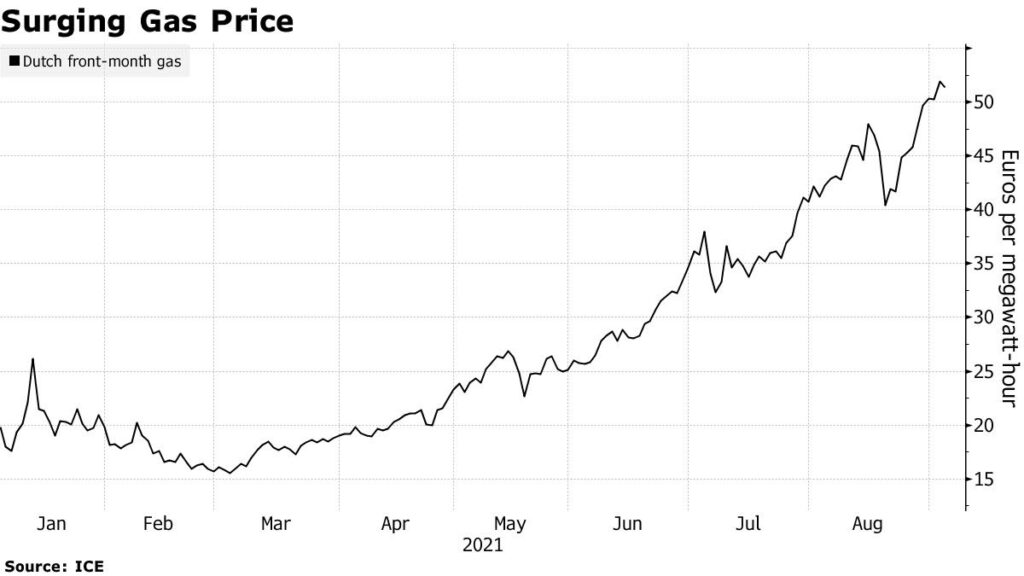

European energy executives warned of a difficult winter ahead as natural gas prices soar to records, a grim prospect for households and businesses recovering from the global pandemic.

Gas prices in Europe are breaking records day after day as economies reopen and people return to the office, boosting demand just as supplies are falling short. That’s fueling inflation and boosting concerns energy-intensive industries from fertilizers to steel and even food makers will need to slow down.

Prices are rallying even though it’s summer, when demand is usually low. That’s because a long winter left gas storage sites across Europe depleted, with inventories currently at their lowest level for this time of year in more than a decade. Austria’s energy company OMV AG said it’s still trying to catch up from last year’s deep chill.

“We’ve been running behind the storage delay all summer,” CEO Alfred Stern said late Thursday at a briefing in Vienna. “It will now depend on how cold this winter is.”

Soaring energy prices have already sent German inflation to its highest since 2008. Prices soared 3.4% in August, higher than the 2% rate the European Central Bank is targeting for the euro area. Things could still get worse as electricity prices are now at the highest since 2008 and just about 50 euro cents shy of a record.

Europe is struggling to get the extra gas it needs to refill storage sites as top supplier Russia is facing a crunch of its own, holding back additional deliveries. Outages in the North Sea are disrupting the continent’s own production just as cargoes of liquefied natural gas are being diverted to meet Asian demand.

Soaring gas prices are likely to become a problem for Asia too, Starace said.

The rally also poses a threat to companies banking on gas as a bridge fuel to the transition to low-carbon energy sources, he said. The gains have also helped drive the price of pollution permits in Europe to a record, a move meant to discourage companies from burning more coal.

“Price of gas today is somehow related to CO2 prices, so gas companies, rather than electricity companies, have to be realistic” about the role of gas in the energy transition, he said.

Europe may get some relief later this year if the controversial Nord Stream 2 pipeline from Russia to Germany starts. The current crunch shows why such infrastructure projects are critical, said Stern, whose company helped finance the link.

Russian Energy Minister Nikolay Shulginov said Thursday it’s possible that Nord Stream 2 will start sending more gas to Europe soon as the pipeline is almost complete.

— With assistance by Francine Lacqua