Chevron, one of the world’s largest oil companies, has said in a securities filing that regulations in the state of California may hurt its business in the fourth quarter of 2023.

In a January 2 notice to the U.S. Securities and Exchange Commission, the company said that it “will be impairing a portion of its U.S. upstream assets, primarily in California, due to continuing regulatory challenges in the state that have resulted in lower anticipated future investment levels in its business plans.”

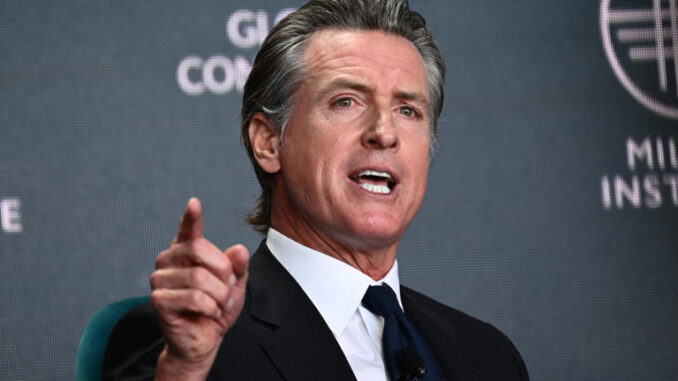

The announcement follows Democratic Governor Gavin Newsom approving legislation in March 2023 that he said would improve oversight of “Big Oil” in the state.

The move will have a financial impact on Chevron’s business, the company said, and will contribute to “non-cash, after-tax charges of $3.5 billion to $4 billion in the company’s fourth quarter 2023 results.”

Newsweek contacted Chevron for comment via email on Thursday morning.

The law had planned to establish an independent entity that aims to “root out price gouging by oil companies and authorizes the California Energy Commission (CEC) to create a penalty to hold the industry accountable,” according to Newsom’s office.

“With this legislation, we’re ending the oil industry’s days of operating in the shadows. California took on Big Oil and won. We’re not only protecting families, we’re also loosening the vice grip Big Oil has had on our politics for the last 100 years,” Newsom said in a statement after he signed the legislation into law last year.

In a letter to the CEC commenting on the legislation and its impact, Andy Walz, Chevron’s Americas products president, suggested that penalties that may be introduced as a result of the legislation may make gas prices more expensive.

“A margin penalty can only serve to further deter investment in the state’s energy market,” Walz wrote. “This is not hyperbole, nor is it merely hypothetical. California’s policies have made Chevron’s investments in its home state riskier than investing in other states, with projects being lower in quality and higher in cost.”

Walz went on to say that Chevron, whose global headquarters are in California, alone has cut back “hundreds of millions of dollars” on its spending in the state since 2022.

“California’s policies have made it a difficult place to invest so we have rejected capital projects in the state,” Walz said.