New England is hell-bent on decarbonizing quickly, and it’s been making some progress. But like it or not, the region still depends heavily on natural gas for both power generation and space heating, and gas supplies are stretched to the limit during periods of extreme winter demand. Worse yet, the Everett LNG import terminal, which for years has fed a big, soon-to-close gas-fired power station and supported the Boston area’s gas grid, may be on the verge of shutting down. Well, help may finally be on the way. Enbridge recently proposed an expansion to its 3-Bcf/d Algonquin Gas Transmission pipeline system. The question is, can it get built in a region notorious for its opposition to energy infrastructure projects? In today’s RBN blog, we discuss Enbridge’s Project Maple and the role it could play in New England’s aggressive plan to reduce its greenhouse gas (GHG) emissions.

Hydrocarbon-related issues in New England have long been a favorite topic in the RBN blogosphere, and not just because they gave us an excuse to joke about Tom Brady, rabid Red Sox fans, and the region’s many quirks and eccentricities — the incomprehensible accents, the unnatural obsession with Dunkin’ coffee and Subaru Outbacks, and the unusual practice of using folding chairs to save parking spaces after snowstorms. No, New England has been interesting to blog about also because of the irony that it’s so close to the Marcellus/Utica, one of the largest natural gas production areas in the world, and yet it can hardly pipe in enough gas to keep the lights on during long winter cold snaps.

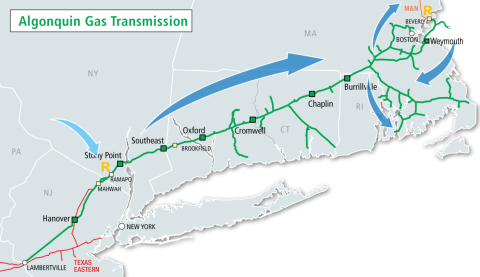

We laid out the basics way back in 2014, in Please Come to Boston. There we explained that five pipeline systems provide the vast majority of New England’s gas: Algonquin Gas Transmission (AGT) and Tennessee Gas Pipeline (TGP) from the south, Iroquois Gas Transmission from the west through upstate New York, and Maritimes & Northeast Pipeline (MNP) along with Portland Natural Gas Transmission (PNGT) from Canada, through New Brunswick and Quebec, respectively. There’s also Constellation Energy’s Everett LNG import terminal near Boston, which has provided fuel for the company’s 1,400-MW Mystic power station (set to shut down in mid-2024) and gas to local distribution companies (LDCs), and Repsol’s Saint John LNG import terminal (formerly called Canaport) up in New Brunswick from which regasified LNG can be piped down MNP into New England.

More recently, in The Tipping Point, we said that almost every effort to significantly expand the capacity of New England’s gas pipeline network — including proposed greenfield projects like Kinder Morgan’s 1.2-Bcf/d Northeast Energy Direct — faced strong regional and local opposition and many failed to secure needed approvals. That has left the region in a particularly tight gas-supply situation during periods of peak winter demand, when LDCs holding firm-service contracts with pipelines take precedence over gas-plant operators with interruptible service. That can leave generators with precious little gas to fight over when temperatures plunge to the single digits (or lower), forcing them to either pay top-dollar prices for gas, switch to a backup fuel (typically diesel or stockpiled LNG), or shut down until the frigid weather eases.

This past June, the Federal Energy Regulatory Commission (FERC) held an all-day New England Winter Gas-Electric Forum in South Portland, ME, to discuss the region’s ongoing energy challenges with a wide range of stakeholders. Among other things, forum participants noted that there is good news on the renewables front: The region is now adding about 700 MW of new solar capacity per year, with a total of about 12,000 MW expected online by 2032, and the 800-MW Vineyard Wind project 15 miles off the coast of Massachusetts’s Martha’s Vineyard is finally under construction and set for full operation in the second half of 2024. (Other big offshore wind projects are on deck.) Stakeholders expressed concern, however, that the fate of the Everett LNG terminal near Boston hangs in the balance now that its largest customer, the gas-fired Mystic power station in Everett, MA, is set to be taken offline next June.

As we said in the introduction to today’s blog, Everett LNG hasn’t just fed regasified LNG to the Mystic station — about three-quarters of the imported LNG is consumed by Mystic — the import terminal and its 3 Bcf of gas storage capacity have also supported the wintertime gas needs of LDCs in the Boston area. ISO-New England has said that the regional electric grid it operates should be able to get by without Everett LNG for the next few years, largely because the region’s many dual-fired power plants — able to run on either natural gas or diesel — stockpile and replenish diesel so the plants can run even if pipeline gas is temporarily unavailable. Still, the grid operator and others acknowledge that there are risks associated with allowing Everett LNG to shut down, and that it would be best if the facility’s owner could line up a few bilateral contracts with large gas customers (presumably generators and LDCs) to cover the roughly $60 million/year cost of keeping the import terminal open.

Enbridge’s Proposed Project Maple Expansion to AGT

Figure 1. Enbridge’s Proposed Project Maple Expansion to AGT. Source: Enbridge

Which brings us to Enbridge’s recent proposal — called Project Maple (see Figure 1) — to expand the midstream giant’s AGT pipeline system through a combination of replacing existing smaller-diameter pipe with larger-diameter pipe, extending pipeline loops in parallel to existing pipeline facilities, and adding compression at existing compressor stations. In the project’s open season, Enbridge said the proposed expansion of the 3-Bcf/d pipeline system was “scalable” and would depend on the level of market commitments but could result in up to 500 MMcf/d of additional capacity at AGT’s Ramapo receipt point in New York (gold “R” to lower-left in map). It also could result in up to 250 MMcf/d of additional capacity at the system’s Salem receipt point near Boston (gold “R” to upper-right), “opening up more access to in-region LNG services to meet end-users’ peak demand,” Enbridge said, adding that the additional capacity could be available “as early as November 2029.” The light-blue arrow in the map refers to incoming gas from the Marcellus/Utica, while the dark-blue arrows indicate the incremental directional flows Project Maple would enable.

The open season, which runs to November 17, noted that gas-fired generation accounts for just over half of the electricity produced in New England and that more than 60% of the region’s gas-fired fleet is directly connected to either the AGT or MNP system — the latter of which is 77.5%-owned by Enbridge — but only about 6% of the gas these generators need to support their peak-demand requirements is under firm-service contracts, with the very large balance secured via interruptible-service agreements. “This untenable disconnect drives New England’s energy prices higher, limits economic competitiveness and growth; strains the region’s bulk power system to the detriment of public safety, reliability and security during times of winter peak energy demand; and often necessitates that the electric system resort to using less environmentally friendly fuel oil for generation,” Enbridge said.

There are other good reasons to beef up the capacity on AGT. For one thing, gas-fired plants have the ability to quickly ramp up or down as needed to offset the variable output of solar facilities and wind farms. As New England generators add thousands of megawatts of solar and wind capacity over the next few years, the need for quickly accessible power — whether in the form of gas-fired peaking plants, pumped-storage hydro or utility-scale batteries — will only increase. Yet another rationale for adding inbound capacity to AGT is that, despite the regional push to decarbonize, the pipeline system’s annual demand on a peak-day basis continues to increase, and LDC demand growth alone is estimated at a total of 6.5% over the next five years. As Enbridge put it, “Project Maple offers an opportunity for this gap to be closed with dedicated capacity right-sized for gas-fired generators‘ needs.”

The open season will help to demonstrate the need for the project — not just to Enbridge but to FERC, which ultimately will decide whether to grant the proposed AGT expansion project a certificate of public convenience and necessity. As we’ve discussed in Bring It on Home and a number of other blogs in recent years, developing even a modest gas pipeline project in the Northeast often requires a high degree of determination and patience — and it could be argued that New England is the most challenging region of all. Still, given that Project Maple’s impact would appear to be limited to existing right of way and that many New England stakeholders view reliable natural gas supply as a critical supplement to renewables, maybe it’s possible that — as we hinted with the song in the title of today’s blog — regulators will approve “just one more” pipeline capacity addition in the land of Red Sox, Patriots, Celtics and Bruins.

“Just One More” was written by George Jones and appears as the sixth song on side one of George Jones’s first compilation album, George Jones Singing 14 Top Country Songs. The song was recorded at Jack Starne’s Beaumont, TX, home studio in September 1956, with Pappy Daily producing. It was released as a single on Starday Records in October 1956 and went to #3 on the Billboard Hot C&W Sides Singles chart. It is one of the earliest examples of drinking songs that Jones became famous for. Ernest Tubb and Johnny Cash both covered the song. Personnel on the record were: George Jones (vocals), and unnamed musicians (steel guitar, baritone guitar, fiddle).

George Jones Singing 14 Top Country Songs is a compilation album of Jones’s early Starday singles and was released by Starday-Mercury in May 1957. The tracks on the album were recorded between August 1955 and March 1957 at Starne’s Beaumont studio, Bradley’s Quonset Hut Studio in Nashville (now a recording classroom for Belmont University), and Gold Star in Hollywood. Jones wrote or co-wrote all the songs on the album, which was produced by Pappy Daily. Eight charting singles were included on the LP.

George Jones (nick-named “The Possum”) was an American country music singer and songwriter. He is considered by many to be the best male country music singer ever. Keith Richards said, “You heard his heart in every note he sang.” Jones sang in church and as a busker on the streets of Beaumont as a teenager, making his professional debut as a singer on KTXJ radio in Jasper, TX, at the age of 16. His first record, the self-penned “No Money in This,” was released on Starday Records in February 1954. He released 80 studio albums, three live albums, 132 compilation albums, and 182 singles. He had more than 160 charting singles in his lifetime. Jones also had several hit records as a duo with his wife, Tammy Wynette, in the 1970s. He was inducted into the Country Music Hall of Fame in 1992. Jones died in Nashville in April 2013 at the age of 81.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack