In a move signaling a strategic pivot toward reclaiming market share amid softening global demand, OPEC+ has reached a preliminary agreement to boost oil production starting in October 2025. Key members of the alliance, including Saudi Arabia and Russia, are set to discuss and likely approve an addition of approximately 137,000 barrels per day (bpd) during a video conference.

This decision marks the beginning of unwinding 1.66 million bpd of voluntary cuts that were originally slated to remain in effect until the end of 2026.

The alliance, which controls about 40% of global oil supply, has been gradually easing restrictions throughout 2025, reflecting a shift from price defense to volume expansion in response to rising non-OPEC+ output from countries like the United States and Brazil.

Are you Paying High Taxes in New Jersey, New York, or California?

Background on the Agreement

The October hike is part of a broader series of production adjustments OPEC+ has implemented this year. Earlier in 2025, the group accelerated increases, adding roughly 2.2 million bpd between April and September, plus an additional 300,000 bpd quota adjustment.

Specific monthly boosts included 548,000 bpd in August and 547,000 bpd in September, primarily from eight core members: Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria, and Oman.

These nations have reaffirmed their commitment to market stability while pursuing higher output to offset lower prices.

The rationale for this latest increase stems from concerns over a potential oil glut, driven by slower demand growth in major economies like China and persistent high production from non-OPEC+ sources. Analysts note that OPEC+ is aiming to manage inventory levels and maintain a backwardated market structure—where near-term prices are higher than future ones—to discourage excessive stockpiling.

However, this strategy carries risks, as additional supply could further depress prices, which have already fallen to around $66.84 per barrel for Brent crude as of early September 2025.

OPEC+ Production Outlook for 2025Looking at the full year, OPEC+ crude oil production is forecasted to average 43.7 million bpd in 2025, according to the U.S. Energy Information Administration (EIA), representing a modest upward revision from earlier estimates.

The International Energy Agency (IEA) projects OPEC+ crude and natural gas liquids (NGLs) to contribute 1.1 million bpd to global supply growth in 2025, with total world oil supply reaching approximately 105.1 million bpd by year-end.

Non-OPEC+ producers, led by the U.S., are expected to drive the majority of growth, adding 1.3 million bpd.

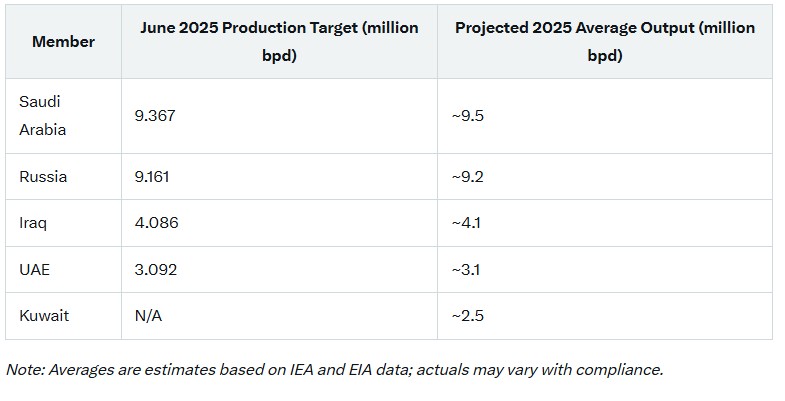

Key production targets for major members in mid-2025 highlight the alliance’s capacity distribution. For instance, in June 2025, Saudi Arabia’s required production level was set at 9.367 million bpd, Russia’s at 9.161 million bpd, Iraq’s at 4.086 million bpd, and the UAE’s at 3.092 million bpd.

These figures reflect ongoing adjustments to voluntary cuts initiated in late 2023, with the group planning further monthly increments of around 400,000 bpd from June to October, potentially totaling an additional 2 million bpd by the end of that period.

Note: Averages are estimates based on IEA and EIA data; actuals may vary with compliance.Spare Capacity: Do OPEC+ Members Have Room to Produce More? A critical question surrounding these increases is whether OPEC+ members possess sufficient spare capacity—the difference between maximum sustainable production and current output—to deliver on their commitments without straining infrastructure.

Bloomberg Writes:

A further acceleration of production increases is likely to please Trump, who has repeatedly called for lower oil prices to help tame inflation and as a means to pressure Russia to end its war against Ukraine. Saudi Arabia’s Crown Prince Mohammed bin Salman is set to visit Washington in November to meet the US president.

If OPEC+ keeps returning about 137,000 barrels a month, it would be on pace to unwind the full 1.66 million barrels within one year.

However, the actual volume is likely to be lower than announced, as some members of the group face pressure to compensate for earlier oversupply and forgo their share of production hikes, while several countries lack spare capacity.

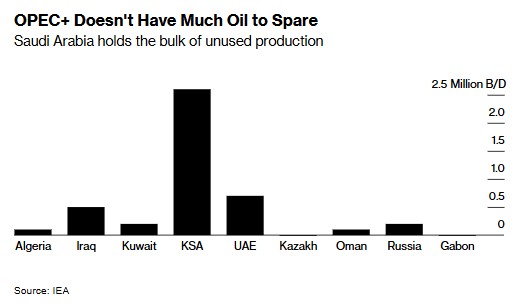

Estimates confirm that the alliance does have substantial spare capacity, though it is unevenly distributed and has been eroding with recent hikes. As of July 2025, the IEA pegs overall OPEC+ spare capacity at 4.61 million bpd, excluding shut-in volumes from Iran and Russia.

This follows a higher figure of 5.7 million bpd in April 2025, concentrated among Gulf producers.

Saudi Arabia holds the lion’s share at 2.59 million bpd, followed by the UAE (0.75 million bpd), Iraq (0.54 million bpd), and Kuwait (0.24 million bpd).

Longer-term projections from the IEA’s “Oil 2025” report indicate OPEC+ spare crude capacity (excluding Iran, Venezuela, and Russia) could reach 6.5 million bpd by 2030, with Saudi Arabia maintaining about half.

However, some analysts warn that real spare capacity may be lower than reported, potentially falling to 1.132 million bpd by late 2025 if increases continue at pace.

By the fourth quarter of 2025, spare capacity might dip below historical averages for the first time since 2021, raising concerns about vulnerability to disruptions.

Members like Saudi Arabia and the UAE clearly have the headroom to ramp up further—Saudi crude capacity stands at 12.1 million bpd in 2024, projected to edge up to 12.3 million bpd by 2030.

In contrast, countries with limited spare, such as Russia and some African producers, may resist aggressive hikes to avoid overproduction risks.

Overall, the alliance’s spare capacity provides a buffer for the modest October increase, but sustained expansions could tighten this margin, potentially leading to market volatility if demand falters.

Implications for Global Energy Markets

This production boost could exacerbate downward pressure on oil prices, benefiting consumers but challenging producers reliant on higher revenues. For Russia, already strained by sanctions and lower export prices, the news is particularly unwelcome, as highlighted in recent discussions on platforms like X.

Meanwhile, Saudi Arabia appears poised to leverage its spare capacity to offset price declines through higher volumes, playing a dual short- and long-term game.

As OPEC+ navigates an uncertain environment—with global demand growth slowing to 680,000 bpd in 2025 per the IEA— the alliance’s ability to balance supply and stability will be tested.

Investors and policymakers should monitor compliance and geopolitical factors closely, as they could reshape the energy landscape heading into 2026.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Be the first to comment