US federal tax regulators and Congress have been addressing offshore wind industry needs to make tax equity financing more efficient, while the Department of Energy revamps its loan program to make $3 billion available to help build the offshore wind industry, experts said April 8.

Tax equity investments have become popular in the US as a way to finance renewable energy projects, with $13 billion made in 2019, Scott Zimmermann, partner with law firm Wilson Sonsini Goodrich & Rosati, said during a webinar about offshore wind supply chain opportunities and challenges.

The webinar was hosted by the National Offshore Wind Research & Development Consortium, a non-profit supported by US DOE and the New York State Energy Research and Development Authority.

Tax equity investors are primarily large financial institutions, with JP Morgan and Bank of America accounting for 50% of the renewable energy tax equity market in 2019, Zimmermann said.

Tax equity investors must be equity owners in the project and they must be for-profit companies that pay US taxes and have a US tax liability. And although Google was one of the first corporations to invest in solar power a few years ago, tax equity investors are mostly large banks, he said.

For offshore wind, tax equity can provide 50% or more of a project’s up-front costs, Zimmerman said.

A production tax credit has also been extended to offshore wind as part of the federal government’s COVID-19 stimulus efforts, but the investment tax credit has always been more lucrative for offshore wind. Even if the PTC were to be extended, the ITC will probably get more attention from offshore wind developers because the technology has higher capital costs and, per unit of energy, offshore wind is more expensive than other renewable energy technologies, he said.

Supply chain implications

To meet tax equity requirements, customers will need evidence of binding contracts, payment, serial numbers, delivery of equipment and other details to prove construction has begun, according to Zimmerman’s presentation.

Offshore wind project suppliers should know that meeting construction deadlines is important, he said, because construction start times and continuity of work are needed to qualify for tax equity. Developers must pass a physical work test showing that work of a “significant nature” has begun, the presentation said.

The other way to qualify involves a 5% safe harbor: where at least 5% of the total cost of the energy project has been paid or incurred. Many developers prefer the physical work test because they do not have to spend as much up front, Zimmerman said.

The Internal Revenue Service and Congress have been taking the unique needs of offshore wind development into account to make tax equity financing work, according to the presentation. But the process still requires considerable tax and legal support as there are numerous requirements. Additionally, tax equity deals are often audited due to the large sums of money involved which highlights the need to meet all required qualifications, he said.

Another way the federal government is trying to accelerate offshore wind industry investment is through the DOE’s energy loan program, Todd Glass, who is also a partner at Wilson Sonsini, said.

The DOE Loan Programs Office began to issue loan guarantees, senior secured debt and other products in 2005, which initially supported 30 energy projects. But only one project has been funded in the last six years as program requirements became more burdensome, Glass said. The program still has $40 billion in lending capacity.

One issue is the “Reasonable Prospect of Repayment” requirement has become “overly conservative” by making developers close long-term contracts for their project’s full volume of energy. Application fees have also reached as high as $400,000, which has reduced interest, Glass said.

However, the Biden administration is working to improve the program, having made Jigar Shah executive director of the DOE Loan Programs Office. Shah founded solar power company SunEdison and most recently served as co-founder and president of Generate Capital, a sustainable infrastructure platform.

“If I know anything about Jigar he is going to find a way to really launch this,” Glass said.

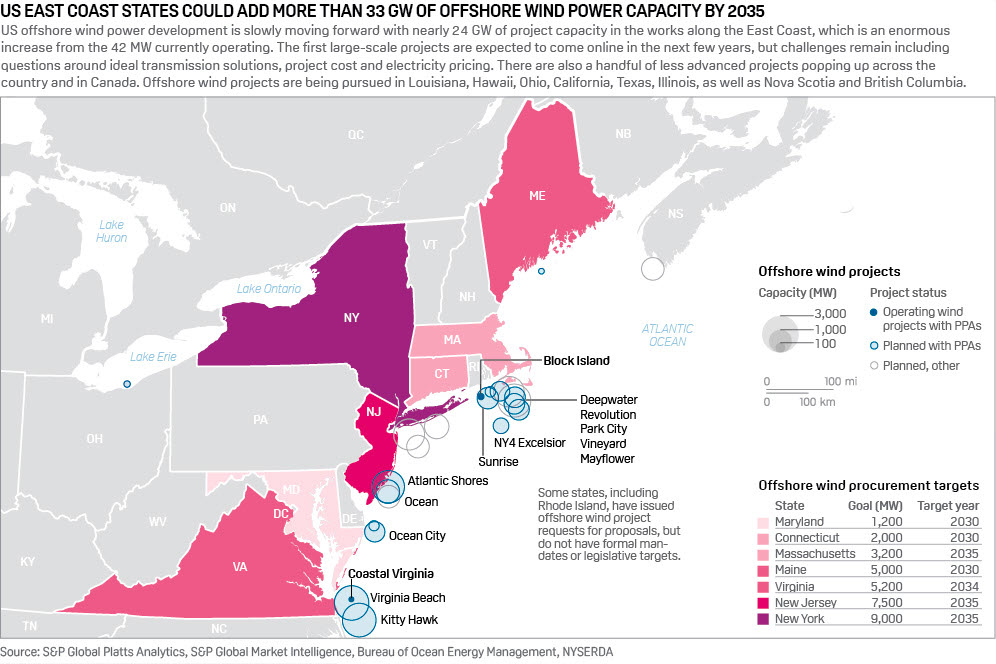

On March 29, the administration set a national goal to deploy 30 GW of offshore wind by 2030 and on the same day the Loan Programs Office issued a fact sheet highlighting how $3 billion available in the loan guarantee program can be leveraged to build a commercial offshore wind industry, according to the presentation.

It appears the loan office will stretch the traditional view of “reasonable prospect of repayment” to include supporting infrastructure like foundation manufacturing facilities, turbine blade manufacturing and support vessel construction, Glass said.

“I would bet DOE will try to get most of the money out the door in the next three years,” he said.