- The deal comes with 19,000 boe/d of production

- Offers early-stage entry, ‘promising’ targets: Platts Analytics

- Chesapeake buys Chief’s Marcellus holdings for $2 billion

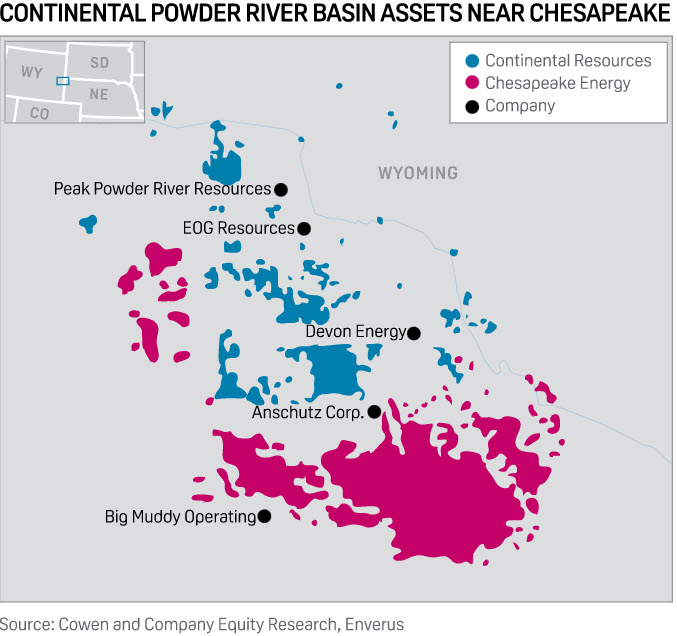

Big independent oil producer Continental Resources said Jan. 25 it will buy Chesapeake Energy’s Powder River Basin oil and gas assets for $450 million in cash, the acquirer’s second significant transaction in the past three months and one which bulks up its operations in the basin it entered last year.

Chesapeake’s PRB assets include roughly 172,000 net acres and 350 operated wells in southeast Wyoming, the company said in a statement. Fourth-quarter 2021 production from the assets are an estimated 19,000 boe/d, 58% of which was crude oil and natural gas liquids. The transaction is expected to close in Q1 2022.

“The Powder River Basin is still in the early phase of development and offers operators the opportunity to get into what could become a very prolific play in the future for very reasonable acreage prices,” said Nathan Hasbrook, supply/production energy analyst for S&P Global Platts Analytics.

“Generally speaking, acreage costs are an order of magnitude less than in the Permian,” Hasbrook said. “There are several promising stacked targets in the Powder River, but only time will tell how productive those formations turn out to be.”

Chesapeake was not particularly active in the PRB in 2021. In September, the natural gas-heavy operator said it had only planned four wells there all year, and to date had averaged just 0.25 of a rig running in the basin.

“A lot of potential exists in the Powder River, but it is really too early to tell how good or bad this basin will be,” Hasbrook said. “More unconventional development is needed.”

The basin currently produces about 143,000 b/d of oil and 680,000 Mcf/d of gas, according to Platts Analytics estimates.

The Chesapeake assets are located about 15 miles south of Continental’s existing position, Cowen analyst David Deckelbaum said in a Jan. 25 investor note.

“In general, over the last couple of years, oil productivity/foot has been roughly 20% better on Continental’s wells versus wells on the acquired acreage,” Deckelbaum said. “As the play is still relatively young, we expect better targeting … over time. However, overall well productivity has been observed to be relatively similar, with a decidedly lower oil cut on the southern acreage that Chesapeake sold.”

Continental’s moves

Continental entered the PRB in early 2021 through purchasing assets from Samson Resources and has been running one to two rigs in the basin since, Deckelbaum said.

Continental had only operated in two basins before the buy: the Bakken Shale in North Dakota/Montana, where it has operated for at least two decades, and the Oklahoma SCOOP-STACK, which it unveiled to industry in 2012.

Chesapeake’s PRB assets represent the second sizable deal Continental has transacted in the past few months. In November, the company closed on a $3.2 billion acquisition of assets in the western Permian Basin, known as the Delaware Basin, from Pioneer Natural Resources in its debut in the giant play of West Texas/New Mexico.

Chesapeake buys Chief Marcellus assets

At the same time Chesapeake sold its PRB assets to Continental, it also made an acquisition of its own: It signed a definitive agreement to buy Chief E&D Holdings and associated non-operated interests held by affiliates of Tug Hill for $2 billion in cash and roughly 9.44 million common shares.

The acquisition, which comes with about 800,000-900,000 Mcf/d of gas production, is expected to close by the end of Q1 2022.

“[That] would allow around 45% of the pro forma gas volumes to receive out-of-basin pricing,” Wells Fargo analyst Nitin Kumar said in a Jan. 25 investor note.

The transaction bulks up Chesapeake’s position in the huge Marcellus Shale play in northeast Pennsylvania, a core area for the company, by adding about 500 new drilling locations in the region, a 25% expansion, and extending its drilling inventory to more than 15 years at current activity levels.

The deal also increases Chesapeake’s Marcellus Shale gas production capacity by up to 200,000 Mcf/d compared through optimization of shared midstream assets, the company said, adding it expects to run one to two rigs over the next several years. After closing, Chesapeake’s portfolio will generate about 75% of its 2022 projected cash flows from natural gas assets and 25% from oil assets.

Source: Global Platts