Net zero will impose significant costs on the rich world over the next two decades, speeding up the economic power shift away from advanced economies.

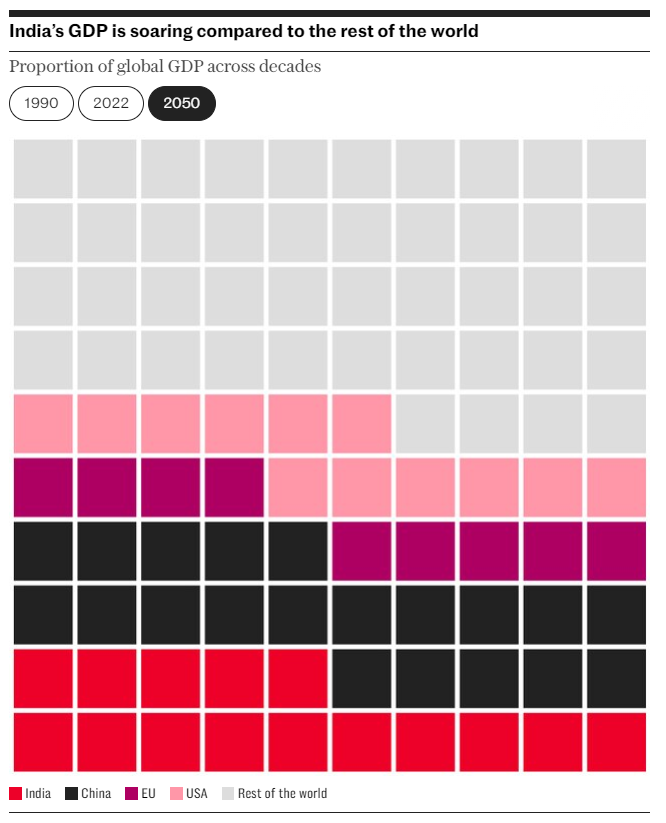

Rapidly growing Asian countries such as Indonesia and Vietnam will continue to grow their share of world GDP to 2050, as ageing populations and rising debt in western economies drag on their growth, according to the Centre for Economics and Business Research (CEBR).

It warned that US debt was becoming “unsustainable” as President Biden spends huge sums on net zero policies under his $500bn Inflation Reduction Act.

Douglas McWilliams, deputy chairman of the CEBR, said: “There is a cost in green investment. And there is the cost of having to restrain various things that otherwise would happen naturally in the economy.”

He also warned that there was unlikely to be a green jobs boom in Britain.

“As you transition, there will be new jobs created. The problem for the UK is a lot of these new jobs are likely to be in places like China that dominate the market for electric vehicles.

“Other than Australia, we have the lowest proportion of our GDP coming from manufacturing and the idea that from such a small base, you will suddenly make the UK into a manufacturing powerhouse I think is pretty unlikely.”

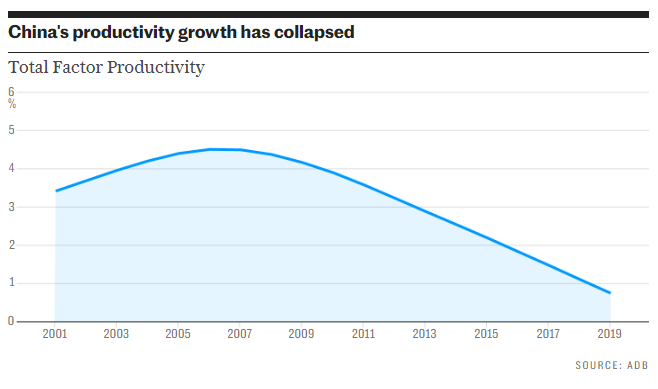

However, the consultancy warned that China’s demographic decline and the scars of its zero-tolerance Covid policy mean the Asian powerhouse may never overtake the US as the world’s largest economy on a sustainable basis. India is expected to become the world’s largest economy by 2080.

The CEBR also predicted that the UK economy will be a fifth larger than France by 2038 in cash terms as the Gallic nation faces ongoing difficulties implementing pension reforms.

However, Nina Skero, chief executive of the CEBR, urged politicians to focus on policies that boost growth.

She said: “Given that we forecast growth will be close to zero in the near term, there needs to be more of a focus on what needs to change to get growth rates closer to those we see in the US.”

She added: “There needs to be a reassessment of the UK’s tax system, with a plan to lower corporation tax in the future that could boost growth. There’s also been a lot of talk but not a lot of action in the public sector to increase productivity, but so far nobody has been able to achieve anything tangible.”

The CEBR’s annual world economic league table highlights the seismic shifts facing the world over the next 15 years.

India is expected to overtake Japan and Germany to become the world’s third largest economy after pulling ahead of the UK last year to become the fifth largest.

Mr McWilliams said: “One of the driving factors behind the changing positions in the league table this year is likely to be the differential pace of implementing net zero policies. The EU is in the lead on this.

“By contrast Asian economies are likely to move less rapidly in the same direction, at a pace where the economic costs are smaller, and countries like India, Korea, Indonesia, Bangladesh, Vietnam and the Philippines are forecast to move sharply up the league table.”

Economists are increasingly warning about the costs of decarbonising the economy. The Organisation for Economic Cooperation and Development recently warned that net zero will leave Britain’s economy £60bn smaller and cost the world as much as $3.6 trillion (£2.8 trillion).

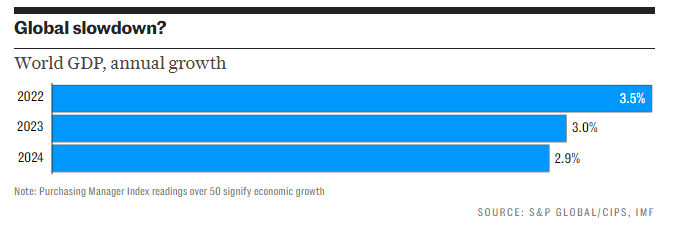

The Paris-based organisation added that the cost of eliminating coal and cutting back sharply on oil and gas will take 0.2 percentage points off global GDP growth in the coming years.

The CEBR also predicted that China’s property crisis and slow recovery from Covid meant it would overtake the US as the world’s largest economy in 2037, not 2036 as predicted last year.

However, it said Beijing’s time at the top will be “unusually short” with an ageing population allowing the US to overtake it again in the 2050s.

The CEBR said: “Looking beyond our normal time horizon, as demographic pressures start to bear we see the US overtaking China again at some time in the 2050s and India becoming the world’s largest economy in the 2080s. This means that China’s period as the world’s largest economy is expected to be unusually short. This would also have implications for global geopolitics, with potentially three superpowers instead of the current two.”

Jeremy Hunt, the Chancellor, said: “Those who talk down the UK are wrong. We have grown faster than any other major European economy since 2010 and the CEBR forecast us to grow faster than France and Germany in the longer term.”